The TRIX (Triple Exponential Moving Average) is a unique and lesser-known momentum indicator that’s highly effective for identifying potential trend reversals and filtering out market noise. Originally developed by Jack Hutson, TRIX focuses on rate-of-change calculations to help traders gauge the strength and direction of a trend. Its structure makes it particularly valuable for crypto traders, who often face high market volatility. This post will explore how to use TRIX, integrate it into automated trading strategies, and apply backtesting to assess its performance in crypto trading bots.

What is the TRIX Indicator

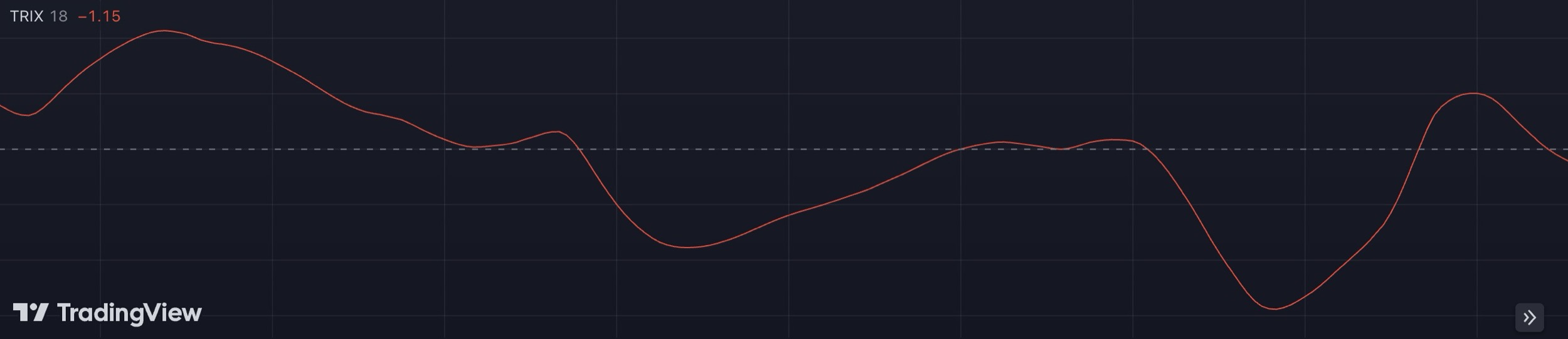

The TRIX indicator is a momentum oscillator that displays the percentage rate of change of a triple-smoothed exponential moving average (EMA). By triple-smoothing the price data, TRIX eliminates minor price fluctuations, allowing traders to focus on significant trends. The result is an indicator that is smooth, reducing false signals, and making it an excellent tool for spotting larger trends.

The TRIX oscillates around a zero line, and its values indicate momentum changes:

- Positive values suggest bullish momentum, indicating potential buy opportunities.

- Negative values suggest bearish momentum, signaling potential sell opportunities.

How to Calculate TRIX

TRIX calculation involves multiple steps, which makes it slightly complex. Here’s a simplified version:

- Calculate a single EMA of the price over a chosen period (e.g., 15 days).

- Calculate a second EMA of the first EMA.

- Calculate a third EMA of the second EMA.

- Finally, calculate the rate of change (ROC) of the third EMA, which is the TRIX value.

While most trading platforms calculate this automatically, understanding these steps can help in fine-tuning your trading strategy. Adjusting the period length can make TRIX more or less sensitive to market moves, depending on your trading style.

Using TRIX in Crypto Trading

Trend Direction

TRIX’s movement above or below the zero line is a key signal:

- When TRIX crosses above zero, it signals a bullish trend, which may be a good entry point.

- When TRIX crosses below zero, it indicates a bearish trend, suggesting it may be time to exit or short.

Identifying Reversals

TRIX can also highlight potential reversals by identifying changes in trend momentum:

- A bullish divergence occurs when the price makes a new low, but TRIX forms a higher low. This may indicate a trend reversal from bearish to bullish.

- A bearish divergence occurs when the price makes a new high, but TRIX forms a lower high, suggesting a possible shift from bullish to bearish.

Filtering False Signals

Since TRIX is a smoothed indicator, it’s effective in filtering out market noise. This makes it ideal for reducing false signals, especially in volatile markets like crypto. Traders looking for a reliable trend-following tool that minimizes whipsaws often find TRIX beneficial in such environments.

Combining TRIX with Other Indicators

To maximize the effectiveness of TRIX, pairing it with other indicators can provide more accurate entry and exit points.

TRIX + Moving Average Convergence Divergence (MACD)

Combining TRIX with MACD can help confirm trend direction and reduce false signals. If TRIX shows bullish momentum while MACD also displays a bullish crossover, this double confirmation strengthens the buy signal.

TRIX + Relative Strength Index (RSI)

Using RSI with TRIX can enhance reversal signals. For example, if TRIX signals a bearish trend while RSI is overbought (above 70), it reinforces a potential sell signal. Likewise, if TRIX shows bullish momentum and RSI is oversold (below 30), this could confirm a buy signal.

TRIX + Average Directional Index (ADX)

ADX helps measure the strength of a trend. When paired with TRIX, it’s possible to assess both the direction and strength of a trend. A strong ADX reading with a TRIX cross above zero suggests a strong bullish trend, while a strong ADX with TRIX below zero indicates a robust bearish trend.

Using TRIX for Scalping and Day Trading

For traders focused on short-term gains, such as scalpers and day traders, the TRIX indicator can be particularly valuable. Its ability to quickly respond to momentum shifts while filtering out minor fluctuations makes it an ideal tool for identifying quick entry and exit points. In fast-paced markets, where timing is everything, TRIX helps traders spot brief, high-momentum opportunities without getting caught in every small movement. By using a shorter period for the TRIX calculation, scalpers can create a highly responsive tool that pinpoints intraday trends, while day traders might find value in slightly longer periods to balance responsiveness with stability.

TRIX as a Tool for Trend Confirmation in Swing Trading

Swing traders, who typically hold positions for several days or even weeks, often seek indicators that confirm trends rather than generate quick entry or exit signals. In this context, TRIX is useful as a trend confirmation tool. By setting a longer period for the TRIX indicator, swing traders can use it to validate the strength and direction of broader price trends. When TRIX is rising above zero and moving upward, it can confirm an existing uptrend, reinforcing the trader's confidence to hold a position longer. Conversely, when TRIX starts declining, it may signal that the trend is losing strength, guiding swing traders toward a potential exit.

Adjusting TRIX Sensitivity Based on Market Conditions

The effectiveness of TRIX can be influenced by the overall market environment. In highly volatile or trending markets, a shorter TRIX period may capture the quick movements more effectively, helping traders react faster to rapid changes. On the other hand, in range-bound or less volatile conditions, a longer TRIX period can help filter out noise and provide a clearer view of underlying trends. Experienced traders often adjust their TRIX settings to match the current market state, allowing them to tailor the indicator’s sensitivity based on whether they are trading in a trending, consolidating, or highly volatile market.

TRIX in Multi-Timeframe Analysis for Enhanced Accuracy

Using TRIX across multiple timeframes can enhance its accuracy, as it allows traders to validate signals within different market perspectives. For instance, a trader might use a TRIX crossover on a higher timeframe, like the 4-hour chart, to confirm a long-term trend, while using a lower timeframe, like the 15-minute chart, for shorter-term signals within that trend. This multi-timeframe approach helps traders avoid false signals, as a trend confirmed across timeframes generally carries more strength and reliability. By aligning TRIX signals across various timeframes, traders can create a more comprehensive view of market dynamics.

Advantages and Limitations of TRIX

Advantages:

- Noise Reduction: Triple smoothing reduces market noise, making TRIX ideal for trend-following.

- Versatility: Effective across various timeframes, though longer periods tend to produce more reliable signals.

- Momentum Measurement: Helps assess trend momentum, aiding in entry and exit timing.

Limitations:

- Lagging Indicator: Due to smoothing, TRIX can sometimes delay signals, especially in fast-moving markets.

- Limited Use in Range-Bound Markets: TRIX performs best in trending markets; during sideways markets, it may produce false signals.

Optimizing TRIX for Your Strategy

For optimal results, consider adjusting TRIX’s parameters and combining it with other indicators. Experimenting with different timeframes and adding conditions like RSI thresholds or ADX values can help refine the strategy for specific market conditions. Additionally, testing with multiple cryptocurrencies and settings will provide insights into how TRIX adapts to various volatility levels. Aldo, You can also set up crypto alerts with our Smart Alert Bots, which notify you instantly when your strategy conditions are met for your chosen trading pair on your favorite exchange.

The TRIX indicator’s unique calculation method and noise-filtering properties make it an attractive tool for crypto traders focused on capturing meaningful trends. While it may not work effectively alone in all market conditions, combining TRIX with other indicators and using backtesting can greatly enhance its effectiveness in an automated trading strategy. Whether you’re a beginner or an experienced trader, adding TRIX to your toolkit could provide the momentum insights needed to make more informed trading decisions.