The Moving Average Convergence Divergence (MACD) is a versatile and widely-used indicator in technical analysis, helping crypto traders identify trend direction and momentum. Originally developed by Gerald Appel in the 1970s, the MACD is particularly valuable in fast-moving markets like cryptocurrency, where trends can shift rapidly. By examining the relationship between two moving averages, the MACD highlights potential entry and exit points, making it a powerful tool in any trader’s arsenal. In this post, we’ll explore how the MACD works, discuss key signals it provides, and cover how you can backtest trading strategies using this indicator to improve your approach. We’ll also show how MACD can be combined with automated crypto trading to help you act on signals 24/7.

What is MACD?

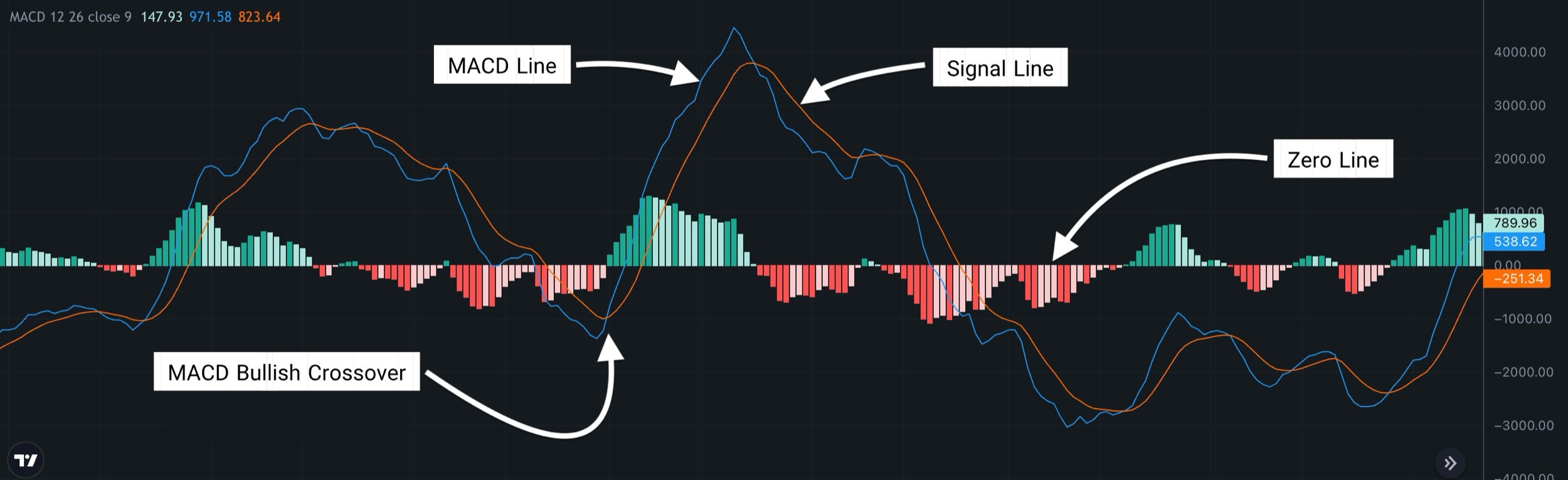

The MACD indicator is composed of three main components:

- MACD Line: The difference between the 12-period and 26-period Exponential Moving Averages (EMAs). This line reflects short-term momentum in relation to long-term trends.

- Signal Line: A 9-period EMA of the MACD line, which acts as a trigger for buy and sell signals.

- Histogram: The graphical representation of the difference between the MACD line and the signal line. Positive values show bullish momentum, while negative values indicate bearish momentum.

Together, these components help traders visualize shifts in trend direction and identify when an asset’s momentum is strengthening or weakening.

Interpreting MACD Signals

The MACD provides several key signals that traders can use to make informed decisions:

MACD Line Crossover

- Bullish Crossover: When the MACD line crosses above the signal line, it’s considered a bullish signal, suggesting an increase in buying momentum. Traders often view this as a signal to enter long positions, especially when it aligns with an upward trend.

- Bearish Crossover: Conversely, when the MACD line crosses below the signal line, it’s a bearish signal, indicating potential selling pressure. This crossover often signals a good exit point or an opportunity to enter a short position if other indicators support it.

Histogram Analysis

- The histogram visualizes the strength of the momentum. When the bars are growing taller, it indicates increasing momentum in the trend’s direction. When they start to shrink, it signals weakening momentum, suggesting the trend may be losing strength and could soon reverse.

Centerline Crossover

- When the MACD line crosses above the zero line, it suggests the short-term momentum is moving higher than the long-term trend, indicating a bullish signal. When it crosses below zero, it suggests the opposite—a bearish sentiment, as short-term momentum falls below the long-term average.

Each of these signals can provide valuable insights on market conditions, making it easier to time entries and exits effectively.

Using MACD in Crypto Trading Strategies

The MACD is well-suited to trend-following and momentum strategies in crypto markets. Here’s how you can incorporate it:

- Trend Confirmation: Use the MACD crossover with the zero line to confirm trend direction. In an uptrend, a bullish crossover above the zero line reinforces the strength of the trend, while a bearish crossover below the line in a downtrend confirms a continuation.

- Identifying Reversals: MACD crossovers are often used to identify trend reversals. When a bullish crossover occurs after a downtrend, it can signal a potential shift to an upward trend. Combining this with support levels or other indicators can provide a solid reversal strategy.

- Combining MACD with Volume: Volume analysis can strengthen MACD signals. For instance, a bullish MACD crossover with rising volume provides stronger confirmation that the market’s upward momentum is backed by buying interest, increasing the likelihood of a successful trade.

Combining MACD with Other Indicators

-

Relative Strength Index (RSI): When paired with MACD, RSI can confirm overbought or oversold conditions. If MACD signals a bullish crossover while RSI is near or below 30 (oversold), it can reinforce the buy signal.

- Bollinger Bands: Bollinger Bands track volatility and price trends. A MACD crossover signal near the lower Bollinger Band can indicate that the asset is oversold and ready for a potential reversal. Similarly, if the crossover occurs near the upper band, it may signal that the asset is overbought, indicating a pullback is likely.

- Moving Averages: Adding moving averages to the MACD strategy can help confirm trends. For example, if a bullish MACD crossover occurs and the price is above the 50-day moving average, it provides stronger confirmation of an uptrend, increasing the reliability of the buy signal.

- Support and Resistance Levels: Support and resistance can provide context to MACD signals. For instance, if a bullish crossover occurs just above a key support level, it reinforces the strength of the signal, making it more likely to hold.

Advantages and Limitations of MACD

Advantages:

- Versatile in Different Market Conditions: MACD can be used in both trending and range-bound markets, offering flexibility in diverse trading scenarios.

- Clear Signals for Entry and Exit: The MACD line and signal line crossovers provide easy-to-interpret buy and sell signals.

- Momentum and Trend Analysis in One Indicator: MACD combines trend and momentum, giving traders a comprehensive view of the market.

Limitations:

- Lagging Indicator: As a trend-following indicator, MACD can sometimes produce delayed signals, which may lead to missed opportunities in highly volatile markets.

- False Signals in Sideways Markets: MACD may generate false signals during periods of low momentum or consolidation. Combining MACD with other indicators can help filter these out.

- Not Suitable for All Timeframes: MACD is generally more effective on higher timeframes, as it can be prone to noise on shorter periods like 1-minute or 5-minute charts.

Understanding these limitations allows traders to apply MACD with realistic expectations and in the right context.

Practical Tips for Using MACD in Crypto Trading

- Combine with Other Indicators: Since MACD alone may sometimes lead to false signals, pairing it with additional indicators (like RSI or support levels) can increase reliability.

- Adjust Timeframes to Suit Trading Style: Swing traders may find the MACD most useful on 4-hour or daily charts, while day traders may prefer the 15-minute or 1-hour timeframe.

- Test Settings for Your Asset: Different crypto assets may react differently to MACD settings. Experiment with the EMAs (e.g., 8, 21, and 5 for faster signals) to suit specific pairs.

The MACD indicator is a powerful tool for crypto traders, offering insights into both momentum and trend direction. By understanding how to interpret MACD signals, you can make more informed decisions on entry and exit points. Additionally, combining MACD with other indicators like RSI or Bollinger Bands can enhance its accuracy, reducing the risk of false signals.

Whether used manually or as part of an automated strategy, the MACD indicator is a valuable addition to any trading toolkit. You can also use our Smart Alert Bots to get crypto alerts instantly when your strategy condition is met.