The Williams %R indicator, often referred to as Williams Percent Range, is a momentum oscillator developed by Larry Williams. Known for its simplicity and effectiveness, the Williams %R provides insights into overbought and oversold conditions in the market. By highlighting these zones, traders can anticipate potential reversals and adjust their strategies accordingly. This post dives into the fundamentals of the Williams %R, how it works, how we can backtest it, and how traders can integrate it into their automated crypto trading for optimal results.

Understanding Williams %R

Williams %R measures the level of the close relative to the high-low range over a given period, typically 14 days or periods. Its values range from -100 to 0, where readings near -100 indicate that the asset is oversold, while values near 0 suggest overbought conditions. Unlike other oscillators that may be more complex, Williams %R’s simple range provides a quick and clear signal for traders looking to spot market extremes.

For instance, if the Williams %R reading is closer to -100, it suggests that the asset’s closing price is near the low end of the recent range, indicating potential buying interest as the asset might be undervalued. Conversely, readings close to 0 mean the price is nearing its recent high, hinting that the asset could be overbought and due for a correction.

How to Calculate Williams %R

To calculate the Williams %R indicator, use this formula:

Williams %R = [(Highest High - Current Close) / (Highest High - Lowest Low)] x -100

In this formula:

- Highest High is the highest price reached over the chosen period (typically 14 days or periods).

- Lowest Low is the lowest price reached over that same period.

- Current Close is the most recent closing price.

The resulting value will range between -100 and 0. When the Williams %R is closer to -100, it suggests the asset is oversold, while values closer to 0 indicate that it may be overbought. This quick calculation helps traders gauge where the price stands within its recent range, providing insight into possible entry or exit points.

Interpreting Williams %R in Crypto Markets

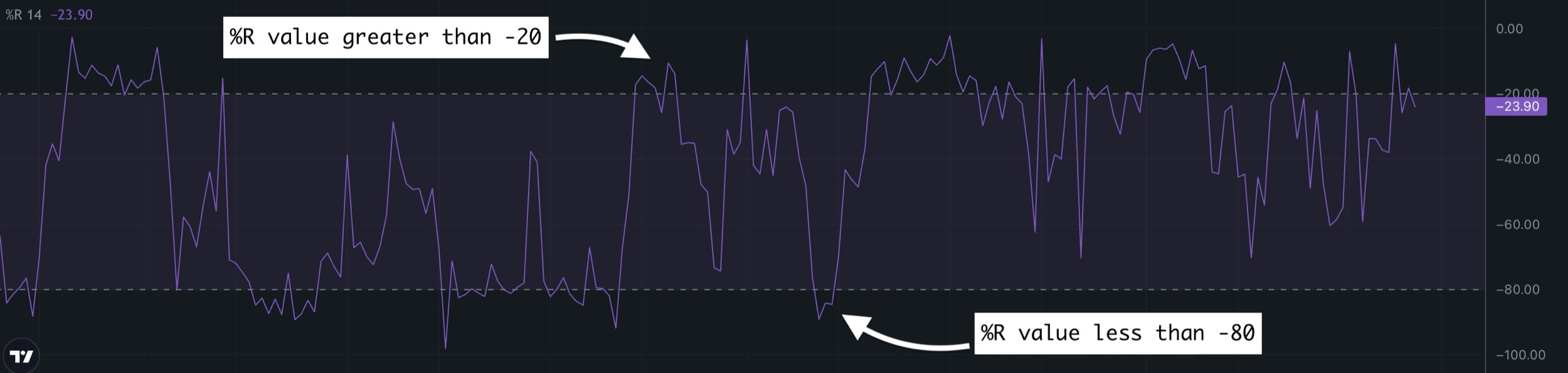

In the highly volatile crypto markets, Williams %R can be an effective tool to help traders navigate the constant ups and downs. A Williams %R reading above -20 usually signals that an asset is in the overbought territory, suggesting it might be nearing a peak. On the other hand, a reading below -80 indicates oversold conditions, potentially signaling that a bottom is near.

For instance:

- Overbought Levels (-20 to 0): When Williams %R enters this range, it may be a signal for traders to prepare for a possible reversal. For crypto traders, this could mean taking profits on long positions or waiting for a pullback.

- Oversold Levels (-80 to -100): When the indicator falls into this zone, it suggests that the asset may be undervalued, offering a potential entry point for buyers expecting a reversal to the upside.

Applying Williams %R in Crypto Trading

Crypto traders can use the Williams %R in various ways. It can be effective as a standalone indicator or, more commonly, when combined with other tools like moving averages, RSI, or MACD. Here’s how it can be applied:

Identify Reversal Points

Traders often use Williams %R to spot potential reversal points, especially in highly volatile assets like Bitcoin or Ethereum. An entry at oversold levels with an exit at overbought levels is a common strategy.

Confirm Trends

When combined with trend indicators, Williams %R can confirm the direction of a trend. For example, if the price is in an uptrend but Williams %R shows oversold levels, it could confirm the strength of the trend and provide a buy signal.

Short-Term and Long-Term Analysis

Williams %R is versatile in that it can be used on multiple timeframes. Crypto traders can use it to identify short-term entry and exit points while also analyzing long-term trends.

Combining Williams %R with Other Indicators

Williams %R works exceptionally well when combined with other technical indicators, enhancing its effectiveness. Here are a few complementary tools:

- Relative Strength Index (RSI): When both Williams %R and RSI indicate oversold conditions, it strengthens the potential for a bullish reversal, offering a more reliable buy signal.

- Moving Average Convergence Divergence (MACD): If the MACD also signals a shift in momentum when Williams %R reaches an extreme level, it can confirm an entry or exit decision.

- Bollinger Bands: Combining Williams %R with Bollinger Bands allows traders to spot price reversals at the bands’ outer edges, especially when Williams %R confirms overbought or oversold conditions.

While Williams %R is powerful on its own, it becomes even more effective when used in combination with other technical indicators. By pairing Williams %R with indicators like Moving Averages (MA) or the Relative Strength Index (RSI), traders can add an extra layer of confirmation to their strategies. For example, if Williams %R shows the asset is oversold (values close to -100), a trader could look for a Moving Average crossover to confirm a potential reversal. Similarly, when Williams %R and RSI both indicate oversold conditions, it may be a stronger signal that a bullish reversal is on the horizon. By combining indicators, traders can reduce the risk of false signals and make more informed trading decisions. Additionally, you can set up crypto alerts to monitor when multiple indicators align with your strategy, allowing for real-time notifications and a streamlined trading experience. This approach is beneficial for traders who prefer a data-driven methodology, especially when market conditions are volatile.

Using Williams %R for Short-Term and Long-Term Trading

Williams %R is highly versatile and can be adapted for both short-term and long-term trading strategies. For day traders and scalpers, using Williams %R on shorter timeframes, such as 5-minute or 15-minute charts, can help capture quick price reversals in highly liquid assets. In these scenarios, traders often set tighter overbought and oversold thresholds (for instance, -10 and -90) to respond more quickly to market changes. On the other hand, long-term traders might use Williams %R on daily or weekly charts to assess broader market trends. For these traders, waiting for Williams %R to signal overbought or oversold conditions on a longer timeframe helps reduce the noise of short-term volatility, making it easier to identify sustainable trend reversals. Whether used for short or long-term strategies, Williams %R offers flexibility and adaptability, making it a valuable tool for a range of trading styles.

Real-Time Crytp Alerts with Williams %R

Setting up real-time crypto alerts based on Williams %R readings can enhance trading precision. CryptoTailor’s Smart Alert Bots allow you to customize alerts so that whenever Williams %R enters an overbought or oversold level, you receive immediate notifications. This real-time feature helps traders act quickly on potential opportunities without constantly monitoring charts.

Advantages and Limitations of Williams %R

While Williams %R can be a powerful tool, it has its pros and cons.

Pros:

- Simplicity: Williams %R is easy to interpret and quickly highlights potential overbought and oversold conditions.

- Versatile in Different Markets: It’s applicable in crypto markets, forex, and stocks, making it a versatile tool.

- Effective in Sideways Markets: Williams %R is particularly useful in range-bound markets, where it accurately signals reversals.

Cons:

- False Signals in Strong Trends: In trending markets, Williams %R may give premature overbought or oversold signals, leading to potential losses.

- Lagging Indicator: Like most oscillators, Williams %R may lag the actual price movement, so it’s best used in combination with trend indicators.

Conclusion

Williams %R is a straightforward and versatile momentum oscillator that can provide valuable insights into market conditions, especially in volatile crypto trading environments. By identifying overbought and oversold zones, it helps traders pinpoint potential entry and exit points with greater accuracy. However, like all indicators, Williams %R is most effective when used in combination with other tools and properly backtested.

For traders looking to add Williams %R to their strategies, CryptoTailor’s platform offers the perfect environment to backtest and refine your approach, ensuring that it aligns with your unique trading style. With the added benefit of customizable alerts, you can stay ahead in the market and seize opportunities as soon as they arise.