The Piercing Candlestick Pattern is a bullish reversal pattern that offers traders insight into potential upward trend shifts after a downtrend. Recognized by its distinctive two-candle structure, the Piercing Pattern signals that buyers are gaining control, often making it an ideal entry point for those looking to take advantage of a trend reversal. In this guide, we’ll delve into how to identify and interpret the Piercing Pattern, explore ways to integrate it into your trading strategy, and discuss how to backtest this setup. We’ll also touch on setting up crypto alerts and leveraging crypto trading bots to optimize your trades around this powerful pattern.

What is the Piercing Candlestick Pattern

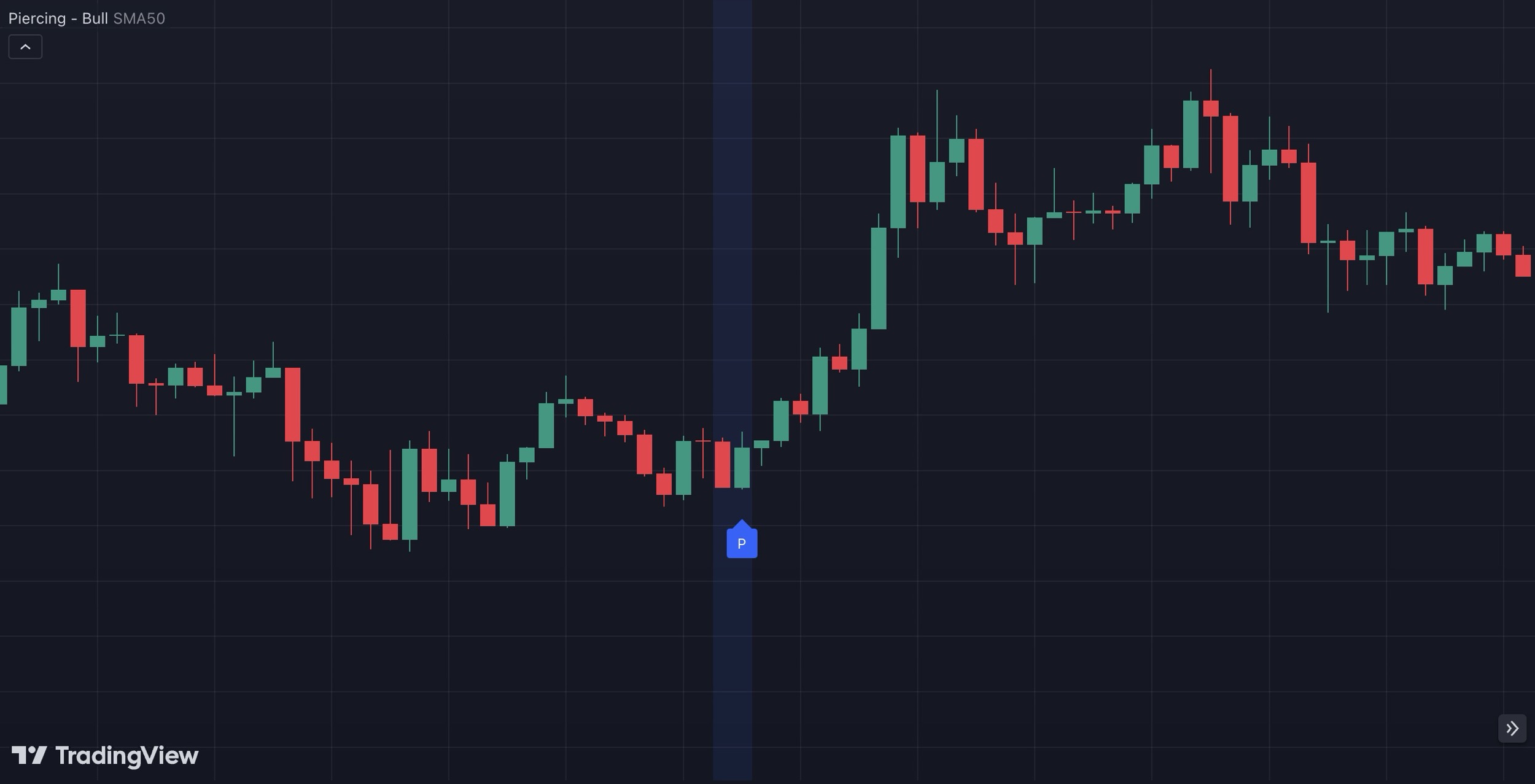

The Piercing Pattern is a two-candle formation that appears during a downtrend. It consists of a large bearish candle followed by a bullish candle that opens lower than the previous close but closes above the midpoint of the bearish candle. This pattern signals a shift in market sentiment, suggesting that buyers are pushing back against selling pressure.

The Piercing Pattern is widely used by traders as a bullish reversal signal and is especially effective in highly volatile markets like crypto, where quick reversals can create profitable opportunities. Recognizing this pattern can give traders a timely heads-up on potential entry points before an uptrend begins.

How to Identify the Piercing Pattern

The Piercing Pattern is relatively straightforward to identify:

- First Candle (Bearish): A large bearish candle appears in a downtrend, indicating strong selling pressure.

- Second Candle (Bullish): The next candle opens below the first candle’s close, creating a gap. It then rises to close above the midpoint of the first candle, signaling a possible reversal.

In the crypto market, where price gaps are less common due to 24/7 trading, the opening of the bullish candle slightly below the close of the bearish candle is often accepted as a valid pattern. This small gap followed by a strong bullish close above the midpoint suggests that buyers are regaining control, making it a promising reversal signal.

Interpreting the Piercing Pattern in Crypto Trading

The Piercing Pattern generally signifies a reversal from a downtrend to an uptrend, as buyers take control following a period of selling. Here’s how to interpret it in different scenarios:

End of a Downtrend

If the Piercing Pattern appears after a sustained downtrend, it signals that the sellers may be exhausted and that buyers are ready to push prices higher. This often marks the beginning of a potential uptrend, making it a suitable time for long entries.

Consolidation Breakout

When the Piercing Pattern appears after a consolidation period, it suggests a breakout from the range, signaling upward momentum. Traders may use this as a cue to enter a trade if other indicators align.

Additional Confirmation

While the Piercing Pattern alone is powerful, using it with other indicators like RSI or MACD can confirm the strength of the signal. For example, if RSI is exiting oversold territory, the Piercing Pattern may indicate a stronger reversal.

The Psychology Behind the Piercing Pattern

Understanding the psychology behind the Piercing Pattern can give traders a deeper insight into why this formation works as a reversal signal. The pattern begins with a bearish candle, suggesting that sellers are dominating the market and pushing prices lower. However, the following bullish candle opens lower than the previous close, signaling further selling pressure. When buyers then step in strongly enough to drive the price up above the midpoint of the bearish candle, it demonstrates that buying momentum has increased significantly.

This shift in momentum can represent a change in sentiment, where sellers begin to lose control, and buyers gain confidence in a possible reversal. The Piercing Pattern, in this sense, reflects a balance shift between supply and demand. It shows that sellers may be exhausted after a sustained downtrend, and buyers are now willing to step in at lower prices, which could indicate a shift in market direction. This understanding helps traders interpret the pattern as more than just a visual signal, adding depth to how they assess potential reversals in market sentiment.

Combining the Piercing Pattern with Other Indicators

Using the Piercing Pattern in conjunction with other indicators can help confirm its signals and increase the likelihood of successful trades. Here are some combinations that work well with this pattern:

- Relative Strength Index (RSI): When the RSI is below 30 (oversold), a Piercing Pattern could indicate a stronger bullish reversal. This combination can signal that sellers are exhausted, giving more confidence in a potential uptrend.

- On-Balance Volume (OBV): The OBV tracks buying and selling pressure based on volume. A rising OBV alongside the Piercing Pattern suggests increased buying momentum, reinforcing the reversal signal.

- Stochastic Oscillator: This momentum indicator works well with the Piercing Pattern to confirm overbought or oversold levels. A low stochastic reading with a Piercing Pattern provides additional support for a bullish reversal.

- Average Directional Index (ADX): ADX measures trend strength. If the Piercing Pattern appears with a low ADX, it suggests that the current downtrend may be weak, making a reversal more likely.

- Volume Analysis: Volume plays a crucial role in confirming the Piercing Pattern. Higher volume on the bullish candle strengthens the pattern’s signal, as it indicates increased buying interest.

Setting Up Crypto Alerts for Piercing Pattern Signals

For traders who want to stay updated without constantly monitoring charts, setting up crypto alerts for the Piercing Pattern can be invaluable. By configuring smart alert bots to notify you when this pattern appears on your chosen trading pairs, you’ll be able to respond promptly to potential trading opportunities. This is especially useful for those who rely on the Piercing Pattern as part of their entry strategy, as timely alerts can allow you to react quickly to market movements and make the most of reversal opportunities.

Advantages and Limitations of the Piercing Pattern

Advantages:

- Clear Reversal Signal: The Piercing Pattern is easy to recognize and provides a strong bullish signal in a downtrend.

- Effective in High Volatility: This pattern works well in crypto due to frequent trend reversals.

- Versatile for Various Timeframes: Can be applied to both short- and long-term timeframes.

Limitations:

- False Signals in Consolidation: The pattern can produce false signals in a sideways market.

- Requires Confirmation: Works best with other indicators to confirm its reliability.

- Dependent on Market Context: More effective at the end of a downtrend than within a strong bearish trend.

Practical Example of the Piercing Pattern in Action

Imagine you’re analyzing a BTC/USDT chart and notice a Piercing Pattern on the 1-hour timeframe after a week-long downtrend. The second bullish candle closes above the midpoint of the previous bearish candle, signaling a potential reversal. With the RSI moving out of oversold territory and increased volume on the bullish candle, you decide to enter a long position. You set a trailing stop loss to lock in profits if the uptrend gains momentum.

This setup exemplifies how the Piercing Pattern can be effectively used, especially when combined with other indicators.

Common Mistakes When Trading the Piercing Pattern

While the Piercing Pattern can be a valuable tool for identifying reversals, there are some common mistakes traders make when using it, especially in volatile markets like crypto. One common mistake is failing to confirm the pattern with other indicators or additional candles. Without confirmation, the pattern can lead to false signals, especially in choppy or low-volume markets where fluctuations may not signify a true trend change. Relying solely on the pattern without waiting for other confirmation can result in premature trades, leading to losses if the trend fails to reverse.

Another common mistake is misinterpreting the gap required for a valid Piercing Pattern. In crypto markets, where 24/7 trading can minimize gaps, a small price difference between the close of the bearish candle and the open of the bullish one is generally acceptable. However, some traders may overlook this nuance, assuming any two-candle structure that meets the general criteria qualifies as a Piercing Pattern. Additionally, traders may enter positions too late, missing out on a significant portion of the reversal. Recognizing these pitfalls can help traders avoid costly errors and improve the effectiveness of the Piercing Pattern in their trading strategy.

Conclusion

The Piercing Candlestick Pattern is a valuable tool for crypto traders seeking to identify bullish reversals after a downtrend. By understanding and recognizing this pattern, traders can improve their timing for entering long positions and enhance their overall strategy. Using it in conjunction with additional indicators, backtesting it on historical data, and incorporating automated alerts can further refine its effectiveness. If you’re looking to expand your trading toolkit, the Piercing Pattern offers a straightforward and reliable way to spot potential trend reversals in volatile markets.