The Hammer candlestick pattern is a popular bullish reversal pattern that often appears at the end of a downtrend, signaling a potential shift in market sentiment. Recognizable by its unique shape, the Hammer pattern shows that buyers are stepping in to counter selling pressure, making it an ideal signal for traders seeking to enter long positions. In this post, we’ll cover how to identify and interpret the Hammer pattern, explore ways to use it within a crypto trading strategy, and highlight the benefits of backtesting this setup. Additionally, we’ll discuss setting up crypto alerts to track this pattern and how automated trading bots can take advantage of its signals in real-time.

What is the Hammer Candlestick Pattern

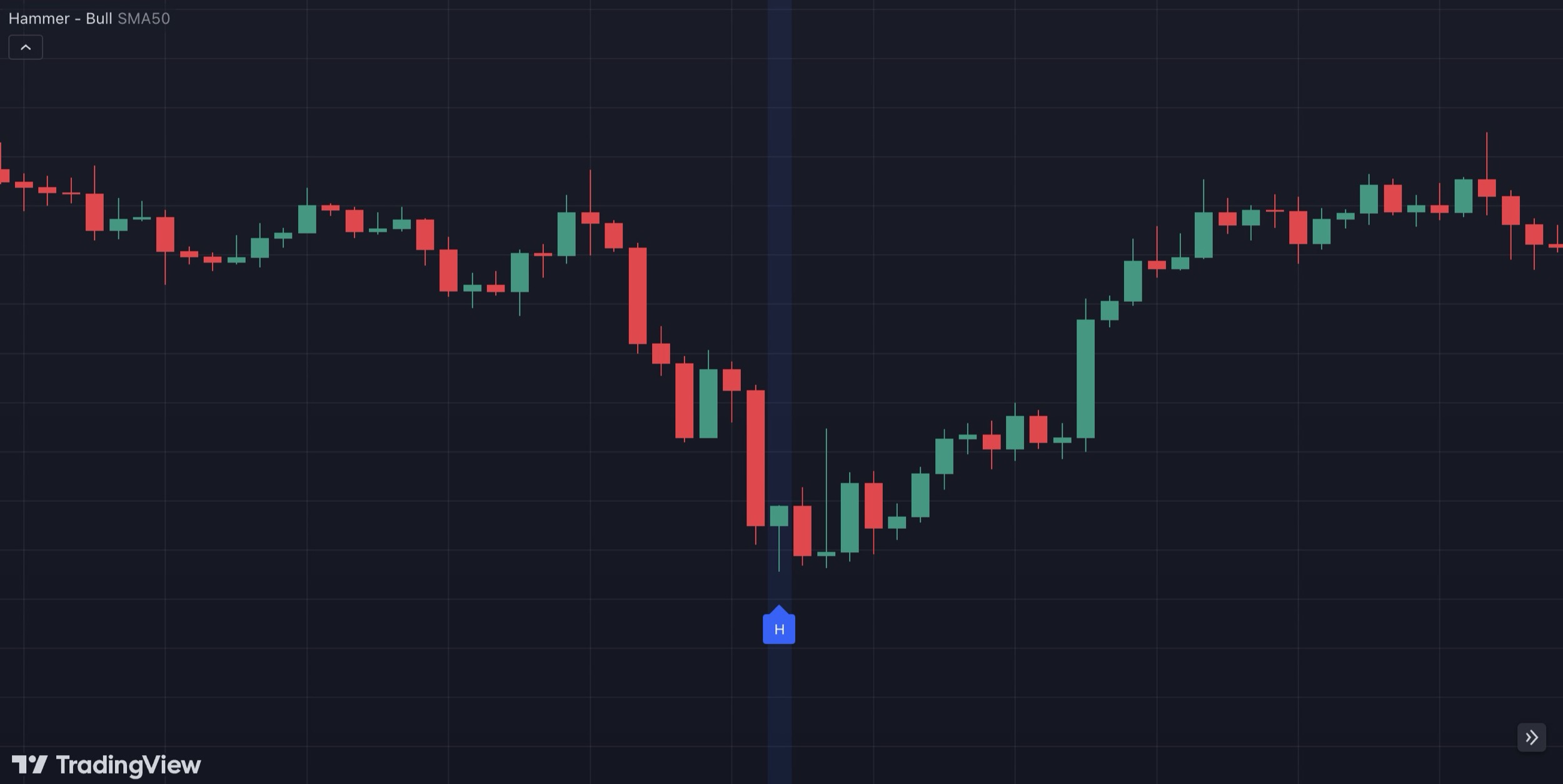

The Hammer pattern is a single-candle formation that typically appears during a downtrend. It has a short body, usually positioned at the top of the candlestick, with a long lower shadow (or wick) that is at least twice the length of the body. This structure indicates that although sellers initially drove the price down, buyers stepped in and pushed the price back up, leaving only a small difference between the open and close prices.

In crypto trading, the Hammer pattern is a strong indication that buyers are gaining control, possibly leading to a reversal of the downtrend. Recognizing this pattern on a chart can give traders valuable insights into potential entry points for long positions.

How to Identify the Hammer Pattern

The Hammer pattern is fairly easy to spot with the following characteristics:

- Small Body: The real body of the candlestick is short, indicating minimal difference between the open and close prices.

- Long Lower Shadow: The shadow below the body is at least twice as long as the body, showing that sellers initially pushed the price lower.

- Little to No Upper Shadow: Ideally, a Hammer has no upper shadow, but a small one is acceptable. This suggests that buyers were able to regain control without significant pushback from sellers.

The Hammer pattern is typically green or white (bullish), but it can also appear as red or black (bearish). While a green Hammer may suggest stronger bullish sentiment, both colors indicate a possible reversal in a downtrend.

Interpreting the Hammer Pattern in Crypto Trading

End of a Downtrend

When a Hammer appears at the end of a downtrend, it indicates that buyers are starting to take control, potentially marking the beginning of an upward reversal. This is usually a strong entry signal for long positions.

In Consolidation Phases

In sideways or consolidating markets, a Hammer may signal a shift in sentiment, indicating that buyers are becoming stronger than sellers, which could lead to a breakout in the upward direction.

Additional Confirmation

While the Hammer is a powerful pattern, it works best with confirmation from subsequent candles or other indicators. A strong bullish candle following the Hammer further confirms the reversal, giving traders greater confidence to enter a trade.

Combining the Hammer Pattern with Other Indicators

For better accuracy, the Hammer pattern can be combined with additional indicators to validate its signal. Here are a few effective combinations:

- Relative Strength Index (RSI): If the RSI is in oversold territory (below 30) when a Hammer appears, it suggests that the downtrend may be exhausted, reinforcing the likelihood of a reversal.

- Moving Average Convergence Divergence (MACD): When the MACD line crosses above the signal line near a Hammer pattern, it strengthens the bullish signal, indicating a shift in momentum.

- Average True Range (ATR): The ATR can help gauge volatility, assisting traders in setting appropriate stop-loss distances for Hammer-based trades. High ATR values signal increased volatility, where a wider stop-loss might be appropriate.

- Volume Analysis: Higher volume on the Hammer candlestick indicates stronger buyer interest, suggesting that the reversal signal is more reliable. Low volume may signal a weaker reversal, requiring further confirmation.

- Fibonacci Retracement: A Hammer near a key Fibonacci retracement level (e.g., 38.2% or 50%) can be a stronger reversal signal, as these levels often act as support during a downtrend.

Setting Up Crypto Alerts for Hammer Pattern Signals

Traders can set up crypto indicator alerts for the Hammer candlestick pattern, making it easier to act on potential reversal signals without constant monitoring. By configuring smart alert bots to notify you when a Hammer pattern appears, you can stay informed about potential buying opportunities as they happen. This approach is especially valuable for traders who rely on the Hammer as part of their entry strategy, as timely alerts can lead to more responsive trades and better results.

Using the Hammer Pattern in an Automated Trading Strategy

Incorporating the Hammer pattern into an automated crypto trading strategy allows for consistent execution of reversal trades, even when you’re away from the screen. Here’s how it can be applied within a crypto trading bot:

- Buy Condition: Set the bot to open a long position when a Hammer pattern appears after a prolonged downtrend, especially if additional indicators (e.g., RSI) confirm the reversal.

- Sell Condition: Implement a trailing stop loss or another indicator-based exit strategy to lock in profits while managing risk if the price reverses again.

By automating trades based on the Hammer pattern, traders can capitalize on reversal signals 24/7, maximizing opportunities in the highly volatile crypto market.

Hammer Pattern Variations

While the classic Hammer is bullish, it’s also important to recognize variations that provide additional insights. The Inverted Hammer, for instance, has a long upper shadow and a small body at the lower end, with little to no lower shadow. Although it doesn’t have the same strength as the classic Hammer, it’s still considered a potential reversal signal when it appears in a downtrend. The Hanging Man is another variation, which resembles the Hammer but appears in an uptrend and is a bearish signal. Understanding these variations can help traders identify a wider range of market conditions and refine their entry and exit strategies.

Practical Example of Using the Hammer Pattern

Imagine you’re analyzing a 1-hour BTC/USDT chart and notice a Hammer candlestick after a week of declining prices. This formation, with a lower shadow twice the length of its body, signals that buyers are stepping in. You decide to open a long position and set a trailing stop loss at -1% to protect against downside risk if the reversal doesn’t hold. With a strong volume confirming the Hammer, you have more confidence in the potential for a trend shift. This example illustrates how the Hammer pattern can be practically applied within a structured strategy for timely entries.

Advantages and Limitations of the Hammer Pattern

Advantages:

- Strong Reversal Signal: The Hammer is widely recognized as a reliable bullish reversal signal, especially at the end of a downtrend.

- Easy to Identify: With its distinct structure, the Hammer is easy to spot on a chart, making it accessible for all traders.

- Works Across Timeframes: The Hammer pattern is versatile and can be used on different timeframes to suit various trading styles.

Limitations:

- False Signals in Sideways Markets: In consolidating or low-volume markets, the Hammer pattern may produce false signals, requiring additional confirmation.

- Reliance on Market Context: The Hammer is most effective in downtrends. Using it in other contexts may lead to less reliable outcomes.

- Confirmation Needed: For best results, the Hammer pattern should be used with other indicators to confirm its validity.

Common Mistakes When Trading the Hammer Pattern

One common mistake traders make with the Hammer pattern is entering trades without waiting for confirmation from subsequent candles or indicators. This can lead to premature trades, especially in markets that lack strong directional momentum. Another mistake is using the Hammer pattern without accounting for volume; low volume on a Hammer candle weakens its reversal signal. Additionally, traders may misinterpret other candlestick patterns with similar structures as Hammers, leading to misinformed trades. Recognizing and avoiding these pitfalls can improve the effectiveness of the Hammer pattern in your trading strategy.

Conclusion

The Hammer candlestick pattern is a powerful reversal signal that can help crypto traders identify potential buying opportunities at the end of a downtrend. By recognizing its unique characteristics and understanding how to interpret its signals, traders can make informed entry decisions. When combined with additional indicators, the Hammer pattern becomes a valuable tool for timing entries in volatile markets. Setting up crypto alerts for this pattern and automating it in a trading bot can further optimize its use, allowing traders to capitalize on reversal opportunities around the clock.