The Tweezer Bottom candlestick pattern is a powerful reversal indicator that can signal the end of a downtrend and the beginning of a potential uptrend. Formed by two candles with nearly identical lows, this pattern indicates that selling pressure is weakening and buyers may be ready to step in. Originally popularized in traditional stock markets, the Tweezer Bottom pattern is also valuable in the crypto market, where quick reversals are common. In this post, we’ll explore how to identify and trade the Tweezer Bottom pattern effectively, including backtesting it and using it in automated crypto trading.

What is the Tweezer Bottom Pattern

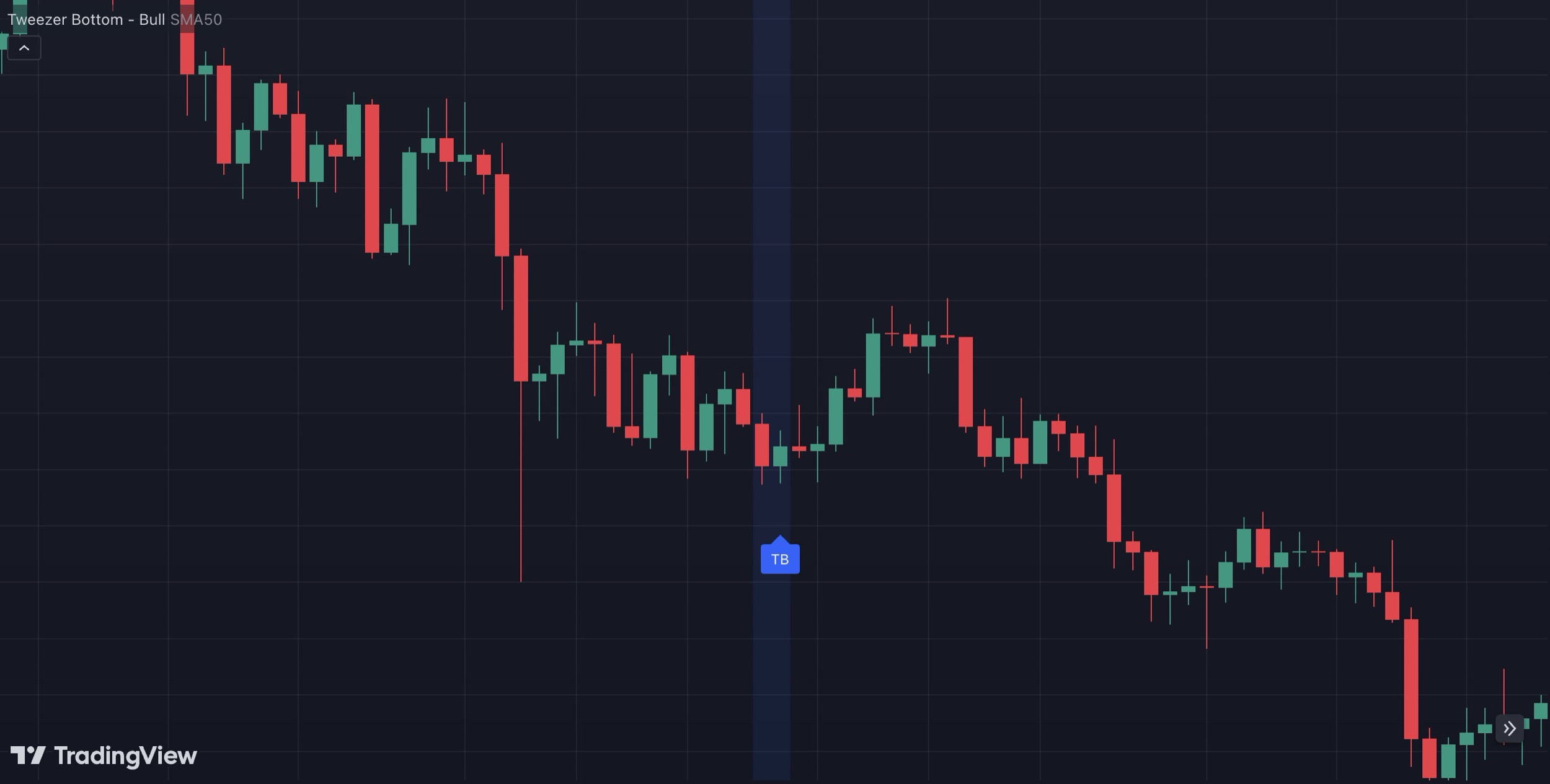

The Tweezer Bottom pattern is a bullish reversal signal that forms during a downtrend. It consists of two candles with nearly the same low price, suggesting strong support at that level. The first candle is bearish, showing that sellers were initially in control, but the second candle is bullish, indicating a shift in momentum as buyers push the price higher. This pattern signals that the asset has likely reached a bottom, and a reversal to the upside may be imminent.

How to Identify the Tweezer Bottom Pattern

Identifying the Tweezer Bottom pattern involves observing two key characteristics:

- First Candle (Bearish): The first candle in the pattern is typically a bearish candle, reflecting a continuation of the downtrend. It has a low price that sets the stage for the reversal.

- Second Candle (Bullish): The second candle opens at or near the previous candle's low but closes higher, showing that buying pressure has returned and sellers are losing momentum.

In some cases, the second candle can have a small body or be a doji, but the key feature is the low price, which is roughly the same for both candles.

Interpreting the Tweezer Bottom Pattern in Crypto Trading

In volatile markets like crypto, Tweezer Bottoms can provide valuable insights:

- Confirmation of Support: When the pattern appears, it shows that a support level has been reached. The near-identical lows across both candles indicate that sellers have exhausted their pressure at this level.

- Shift in Momentum: The bullish second candle suggests a shift in momentum, giving traders confidence that buyers may be stepping in to reverse the trend.

- Risk of False Signals: In markets with extreme volatility, Tweezer Bottoms might occasionally produce false signals. Combining it with other indicators can help validate the reversal.

Using Tweezer Bottoms in Crypto Trading Strategies

- Trend Reversal Signals: The Tweezer Bottom is often used by traders as a signal to enter a long position, especially when combined with additional indicators to confirm the reversal.

- Setting Stop Loss: Since reversals can sometimes be short-lived, setting a stop loss below the Tweezer Bottom pattern can help manage risk if the trend does not continue upward.

- Pairing with Other Indicators: Using indicators like RSI or MACD alongside the Tweezer Bottom can improve the accuracy of trades. For example, if the Tweezer Bottom forms while the RSI is oversold, it strengthens the reversal signal.

Combining Tweezer Bottom with Other Indicators

Relative Strength Index (RSI): When the Tweezer Bottom appears while RSI is in an oversold region, it adds confirmation that a reversal is likely. Oversold RSI suggests that selling pressure has been overextended, aligning with the Tweezer Bottom’s reversal potential.

MACD: A bullish MACD crossover (where the MACD line crosses above the signal line) around the time a Tweezer Bottom forms can enhance the likelihood of a reversal. MACD can provide confirmation that momentum is shifting upward, adding confidence in the signal.

Bollinger Bands: If the Tweezer Bottom forms at or near the lower Bollinger Band, it may indicate an oversold condition. This positioning adds weight to the pattern’s signal, suggesting the price may be ready to move upward towards the middle or upper band.

Tweezer Bottom in Different Market Conditions

In a Downtrend

During a sustained downtrend, the appearance of a Tweezer Bottom pattern can signal a potential trend reversal. Traders often watch for volume increase alongside the pattern to confirm a stronger buying interest.

After a Bearish Run

If the Tweezer Bottom forms after an extended bearish period, it can indicate that selling pressure is finally weakening. This scenario is common in oversold markets, where buyers see a buying opportunity.

In Sideways Markets

In a consolidating market, a Tweezer Bottom could signal a breakout to the upside. Since sideways markets often lack clear direction, the Tweezer Bottom may indicate the market is ready to shift momentum upward.

Why the Tweezer Bottom Works in Crypto Markets

The Tweezer Bottom pattern works well in crypto markets because of its ability to pinpoint potential reversals at critical support levels. Crypto markets are highly volatile, and price movements can quickly shift from bearish to bullish. The Tweezer Bottom’s structure, highlighting the balance between buyers and sellers, helps traders identify when an asset has reached a bottom. The pattern’s simplicity also makes it easy to spot, allowing traders to react quickly and position themselves advantageously. You can easily set create a crypto alert for this indicator that sends you instant notifications when this pattern appears for your trading pair, or even create a smart trade bot, that would execute trades for you 24/7 based on your trading strategies.

Advantages and Limitations

Advantages:

- Simple and easy to spot, even for beginners

- Effective at identifying reversals in a downtrend

- Works well in combination with other indicators for confirmation

Limitations:

- Can sometimes produce false signals, especially in choppy markets

- Requires confirmation from other indicators for higher accuracy

- Limited effectiveness in markets without clear trends

The Tweezer Bottom candlestick pattern is a valuable tool for crypto traders seeking to capture trend reversals and potential price bottoms. While simple in structure, this pattern’s ability to highlight shifts in market sentiment makes it particularly useful in volatile markets. When combined with other indicators like RSI, MACD, or Bollinger Bands, the Tweezer Bottom can be an integral part of a robust trading strategy. Remember, as with any trading tool, using it alongside sound risk management practices is key to maximizing its effectiveness.