Navigating the crypto market can be challenging, but Bollinger Bands simplify the process by decoding price volatility and market trends. This article dives deep into how this powerful indicator works, its practical applications, and how it can be combined with other tools for optimal results. We’ll also explore how to backtest Bollinger Band strategies using historical data and leverage crypto trading bots to automate your trades based on this versatile indicator.

What Are Bollinger Bands

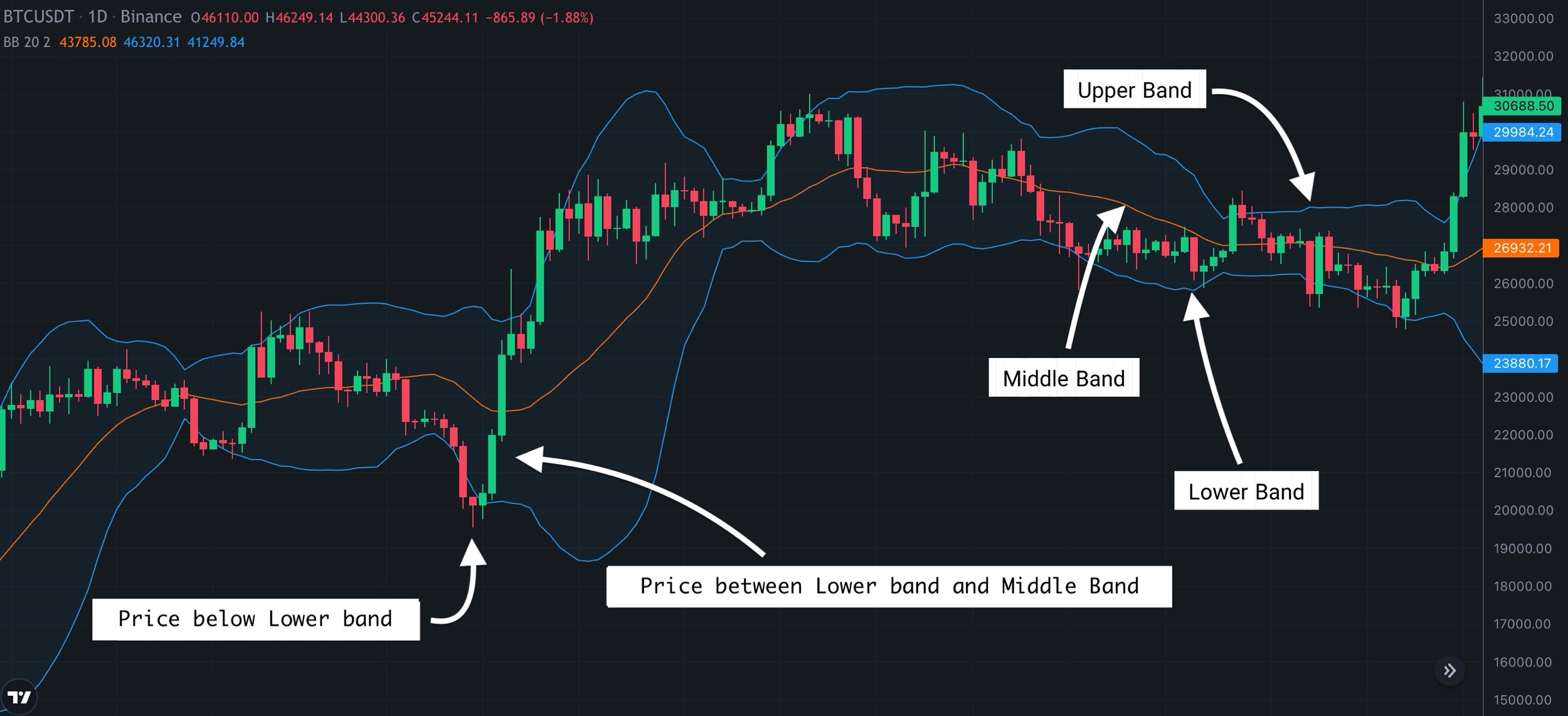

Bollinger Bands are a widely used technical analysis tool created by John Bollinger in the 1980s. They consist of three lines plotted on a price chart, each serving a specific purpose in analyzing market conditions. The primary goal of Bollinger Bands is to measure market volatility and identify potential overbought or oversold conditions. These bands dynamically expand and contract based on market activity, making them adaptable to different assets and timeframes.

The Components of Bollinger Bands

The Middle Band

- This is a Simple Moving Average (SMA), typically calculated over 20 periods (e.g., 20 days or 20 minutes, depending on your chart's timeframe).

- The SMA acts as a baseline, reflecting the average price over the selected period. It provides a central reference point around which the price oscillates.

The Upper Band

- Calculated as the SMA plus two standard deviations of the price.

- The upper band represents the higher threshold of price movements and is often seen as an indicator of overbought conditions. When the price touches or exceeds this band, it signals that the market may be overheated and due for a pullback.

The Lower Band

- Calculated as the SMA minus two standard deviations of the price.

- The lower band represents the lower threshold of price movements and indicates potential oversold conditions. A price touching or falling below this band suggests the market might be undervalued and primed for a reversal.

Why Standard Deviations

Standard deviation is a statistical measure of variability. In Bollinger Bands, it reflects the volatility of the asset. Higher standard deviations mean wider bands, which indicate increased market volatility. Conversely, narrower bands signify low volatility and often precede significant price moves.

How Do Bollinger Bands Work

The dynamic nature of Bollinger Bands is what makes them unique. As volatility increases, the bands widen to accommodate larger price swings. When volatility decreases, the bands contract, signaling a period of market consolidation. This adaptability makes Bollinger Bands suitable for a wide range of assets, from highly volatile cryptocurrencies like Bitcoin to more stable ones like USDT pairs.

Key Features of Bollinger Bands

- Dynamic Nature: Unlike fixed indicators, Bollinger Bands adjust to the asset’s price behavior in real-time.

- Volatility Indicator: They visually represent how volatile the market is at any given moment.

- Trend Awareness: While not primarily a trend indicator, the slope of the middle band (SMA) can hint at overall market direction.

Bollinger Bands are favored by traders of all levels, from beginners to seasoned professionals.

How to Interpret Bollinger Bands

Bollinger Bands provide visual cues about market conditions:

- Squeeze: When the bands contract, it indicates low volatility and often precedes a breakout.

- Expansion: Wider bands reflect higher volatility and potential trend changes.

- Price Touches Bands: When the price touches the upper or lower band, it signals overbought or oversold conditions, respectively.

Combining Bollinger Bands with Other Indicators

- Bollinger Bands + Relative Strength Index (RSI): Pairing Bollinger Bands with RSI helps confirm overbought or oversold conditions. For example, if the price hits the lower band and RSI is below 30, it may indicate a strong buy signal.

- Bollinger Bands + MACD: Use MACD to confirm the direction of breakouts. For instance, if the price breaks above the upper band and MACD shows a bullish crossover, it strengthens the buy signal.

- Bollinger Bands + ATR: Adding Average True Range (ATR) helps gauge the strength of breakouts. A higher ATR indicates strong momentum when the price moves outside the bands.

Psychological Insights: Why Bollinger Bands Work

Bollinger Bands are not just a mathematical tool; they capture the psychological dynamics of market participants. The indicator reflects traders’ collective sentiment, fear, and greed, which drive price movements. When prices approach the upper band, traders often perceive the asset as overbought, sparking fear of a potential reversal and leading to selling pressure. Conversely, when prices touch the lower band, they are seen as oversold, encouraging traders to buy, driven by the fear of missing out (FOMO) on a reversal.

The middle band, representing the moving average, acts as a psychological benchmark. Traders tend to reassess positions when prices cross this line, interpreting it as a shift in momentum. For instance, in an uptrend, a bounce off the middle band might reinforce bullish sentiment, prompting further buying.

Additionally, the contraction and expansion of the bands (squeezes and breakouts) reflect market indecision followed by resolution. A tight squeeze indicates low volatility, often caused by traders waiting for a catalyst. When a breakout occurs, it captures the collective reaction to new information, driving prices dramatically.

By understanding these psychological patterns, traders can anticipate market behavior and align their strategies with prevailing sentiment, enhancing the reliability of Bollinger Bands as a tool.

Customizing Bollinger Band Settings for Crypto

The default Bollinger Band settings—20-period moving average with two standard deviations—work well in many markets, but crypto’s unique volatility often demands customization. Adjusting these parameters can help traders better adapt the indicator to specific crypto pairs, timeframes, and trading styles.

For shorter-term trading or scalping, reducing the period to 10 or 14 can make the bands more responsive to rapid price changes, allowing traders to capture quick reversals. This is particularly useful in highly volatile pairs like BTC/USDT or ETH/USDT, where small timeframes reveal frequent opportunities.

In contrast, long-term investors may prefer extending the period to 30 or more to smooth out noise and focus on broader trends. Increasing the standard deviation to 2.5 or 3 can also help filter false signals in choppy markets, where minor fluctuations might otherwise trigger unnecessary trades.

Another customization involves adapting Bollinger Bands for specific assets. For instance, altcoins with low liquidity may benefit from wider bands, while stablecoins with minimal volatility might require narrower bands for meaningful insights.

Crypto traders can experiment with these settings through backtesting to find the optimal configuration for their preferred asset and trading strategy, ensuring Bollinger Bands remain a tailored, effective tool.

Comparing Bollinger Bands with Keltner Channels

Bollinger Bands and Keltner Channels are both popular indicators for measuring volatility and price trends, but they differ significantly in their calculations and applications. Understanding these differences can help traders decide which tool to use in specific scenarios.

Bollinger Bands are based on a simple moving average (SMA) and standard deviations, making them highly sensitive to volatility. The upper and lower bands dynamically adjust to market conditions, expanding during high volatility and contracting during low volatility. This adaptability makes Bollinger Bands ideal for spotting potential breakouts or reversals, especially in crypto markets where price swings are frequent.

Keltner Channels, on the other hand, use the Average True Range (ATR) to calculate the distance of the upper and lower channels from the exponential moving average (EMA). Unlike Bollinger Bands, Keltner Channels are smoother and less reactive to short-term price spikes. This makes them better suited for identifying trends and setting dynamic stop-loss levels during trending markets. In summary:

- Use Bollinger Bands to identify overbought/oversold conditions and volatility-driven breakouts.

- Use Keltner Channels for trend-following strategies and consistent price movement analysis.

Combining these two indicators can provide a comprehensive view of the market, balancing sensitivity and stability for informed trading decisions.

Beyond Basics: Advanced Bollinger Bands Techniques

Bollinger Bands are incredibly versatile, but advanced techniques can take their effectiveness to the next level. By applying these strategies, traders can gain deeper insights into market movements and refine their trading decisions.

Double Bollinger Bands Strategy

The Double Bollinger Bands (DBB) strategy involves using two sets of Bollinger Bands with different standard deviation settings, such as 1 and 2 standard deviations. This approach provides additional clarity on the strength of trends and potential breakout opportunities.

The inner bands (set at 1 standard deviation) create a tighter range that captures more subtle price movements, while the outer bands (set at 2 standard deviations) define broader volatility extremes. For example:

- Breakout Confirmation: If the price moves beyond the outer band, it signals strong momentum, often confirming a breakout.

- Trend Strength: A price movement that remains within the inner bands during a trend indicates a steady and sustainable price movement, allowing traders to hold positions with confidence.

- Reversal Identification: When the price oscillates between the inner and outer bands, it suggests potential reversals or weakening trends.

This strategy is particularly useful in volatile crypto markets, as it adds an extra layer of precision to identifying entry and exit points. By combining DBB with additional indicators like RSI or MACD, traders can further filter signals and reduce false positives.

Bollinger Bands as Dynamic Support and Resistance

Bollinger Bands aren’t just tools for identifying volatility—they also act as dynamic support and resistance levels in trending markets. During an uptrend, the lower band often serves as support, where prices bounce back upward after touching or nearing the band. Conversely, in a downtrend, the upper band acts as resistance, where prices tend to reverse downward.

Traders can use this behavior to set more adaptive stop-loss levels and profit targets:

- Stop-Loss Management: Setting a stop loss just beyond the lower band in an uptrend or the upper band in a downtrend provides a logical buffer that accommodates natural market fluctuations.

- Profit Targets: Traders can use the bands to predict where prices are likely to pause or reverse, helping to lock in gains more effectively.

By treating Bollinger Bands as dynamic zones rather than static lines, traders can better align their strategies with real-time market conditions. These advanced techniques enhance the usability of Bollinger Bands, making them indispensable for traders aiming to navigate complex and fast-changing markets.

Automating Trading with Bollinger Bands and Crypto Trading Bots

Automating your trading strategies with Bollinger Bands is a game-changer, especially in the highly volatile crypto market. By integrating Bollinger Bands into a crypto trading bot, you can execute trades based on precise market conditions without constant manual monitoring. Bollinger Bands are ideal for automation because their dynamic nature adapts to real-time price movements, providing clear signals for entry and exit points. For instance, a bot can be programmed to buy when the price touches the lower band (oversold) and sell when it reaches the upper band (overbought), ensuring timely actions that capitalize on market trends.

Crypto trading bots also allow you to combine Bollinger Bands with other indicators like RSI or MACD for added confirmation, filtering out weaker signals. This multi-indicator approach increases the reliability of trades while reducing emotional decision-making. Additionally, advanced bots can utilize Bollinger Band strategies like the "squeeze" breakout to identify high-potential trades during low-volatility phases.

With automated alerts and trade execution, bots ensure that no opportunity is missed, even in a 24/7 market like crypto. Platforms like CryptoTailor enable users to create and backtest Bollinger Band strategies, transforming them into automated bots tailored to their risk tolerance and trading goals. Automation turns Bollinger Bands into a powerful tool for consistent, emotion-free trading.

Bollinger Band Width Indicator

The Bollinger Band Width indicator is a derivative of Bollinger Bands, designed to measure the distance between the upper and lower bands. By quantifying this distance, the Band Width provides a clear picture of market volatility, helping traders anticipate potential breakouts or trend reversals.

When the Band Width is narrow, it indicates a "squeeze" phase, where volatility is low, and the market is consolidating. This often precedes a significant price move, making it a critical signal for traders. For example, a narrowing Band Width in BTC/USDT might suggest that the price is gearing up for a breakout in either direction.

Conversely, a wide Band Width reflects high volatility, which typically occurs during sharp price movements or after a breakout. Traders can use this information to determine whether to stay in a position or prepare for a potential reversal as the price settles.

The Bollinger Band Width is especially useful in range-bound markets, where it can help identify when a breakout is imminent. Setting alerts for sudden changes in Band Width ensures traders are ready to act on emerging opportunities. By incorporating the Band Width indicator into their strategies, traders can enhance their ability to navigate both trending and consolidating markets.

Advantages and Limitations

Advantages

Bollinger Bands are among the most versatile and widely used indicators in trading due to their adaptability across different markets and timeframes. One of their greatest advantages is their ability to visually represent market volatility, allowing traders to identify potential breakout or reversal zones easily. When the bands contract during a squeeze, it signals low volatility and alerts traders to prepare for potential market moves. Conversely, expanding bands indicate increased volatility, helping traders gauge the strength of ongoing trends.

Another advantage is their ability to adapt dynamically to price action. Unlike static indicators, Bollinger Bands adjust to market conditions in real-time, providing traders with a reliable framework regardless of the asset being traded. For range-bound markets, the upper and lower bands act as dynamic support and resistance levels, enabling traders to identify bounce zones effectively. In trending markets, the middle band (simple moving average) serves as a guide for retracement opportunities.

Bollinger Bands are also easy to use and integrate with other indicators. When paired with tools like RSI or MACD, they offer stronger signals for entry and exit points, reducing the risk of false trades. These qualities make Bollinger Bands a must-have tool for traders seeking a comprehensive view of market behavior.

Limitations

Despite their strengths, Bollinger Bands have limitations that traders must consider. One key drawback is their reliance on standard deviation, which assumes that price movements are normally distributed. In highly volatile or unpredictable markets, such as crypto, this assumption may not hold, leading to potential inaccuracies in band positioning. As a result, Bollinger Bands alone may not always provide reliable signals in chaotic or erratic trading conditions.

Another limitation is their susceptibility to false signals during choppy, range-bound markets. For instance, prices touching the upper or lower bands don’t always result in a reversal, especially when the market lacks clear direction. This can lead to premature entries or exits if used in isolation. To mitigate this, traders often combine Bollinger Bands with complementary indicators like volume-based tools or momentum oscillators to confirm signals.

Additionally, Bollinger Bands do not provide specific buy or sell points, leaving traders to interpret their signals based on personal judgment or additional indicators. This can lead to inconsistencies if the trader lacks experience or a solid strategy. Finally, their lagging nature—due to reliance on past price data—means they may not react quickly enough to sudden market changes, potentially causing delayed responses in fast-moving markets.

Final Thoughts

Bollinger Bands remain a versatile and powerful tool for analyzing crypto markets. By understanding their nuances and combining them with other indicators, you can develop a robust trading strategy. Take your Bollinger Bands trading to the next level by leveraging automation and smart alerts to stay ahead in the fast-paced world of crypto trading.