The Money Flow Index (MFI) is a versatile momentum indicator that measures the buying and selling pressure on an asset by analyzing both price and volume. Known as the "volume-weighted RSI," the MFI provides unique insights into market trends and potential reversal points by integrating volume data, making it particularly valuable for crypto trading. In this guide, we’ll explore how traders can utilize the MFI in various market conditions, how it compares to other indicators, and backtest examples to see its effectiveness. We’ll also look into combining the MFI with other indicators to create well-rounded trading strategies, which can later be backtested and automated into crypto trading bots for 24/7 trading.

What is the Money Flow Index (MFI)

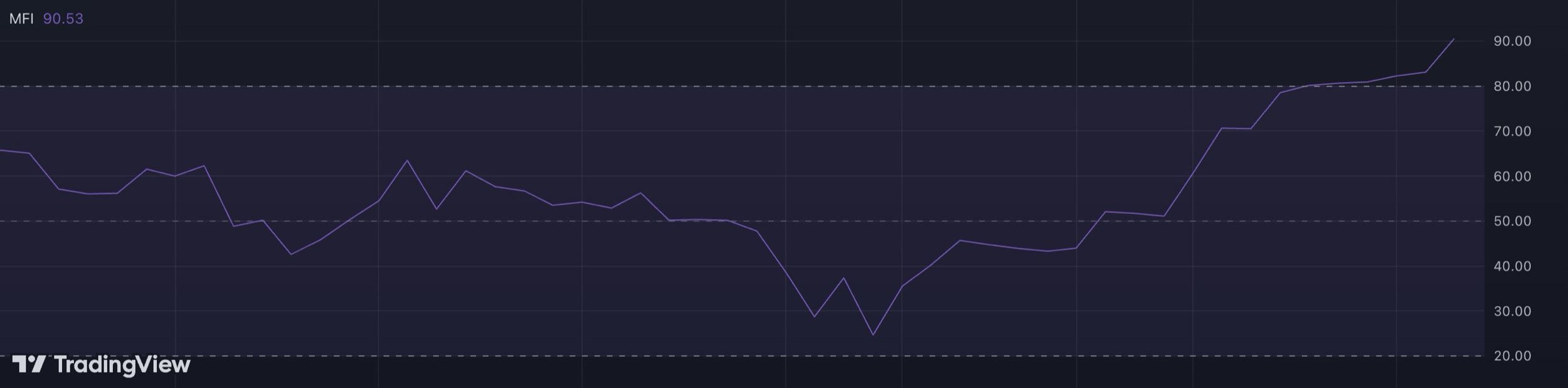

The Money Flow Index is a technical indicator that oscillates between 0 and 100, similar to the RSI, but with a significant difference: it includes volume in its calculations. By examining both price movement and trading volume, the MFI assesses whether money is flowing into or out of an asset. Generally, an MFI above 80 suggests overbought conditions, while an MFI below 20 signals oversold conditions.

The formula for calculating MFI is more involved than simple momentum indicators like the RSI, but the volume factor can provide a more nuanced understanding of market strength.

How to Interpret the MFI

Interpreting the MFI involves looking at specific levels, crossovers, and divergences:

Overbought and Oversold Levels

When MFI moves above 80, it indicates an overbought market, signaling a potential pullback or reversal. Conversely, an MFI below 20 suggests an oversold market, hinting at a possible upward reversal.

Divergences

If the price is making new highs while the MFI declines, it can be a bearish divergence, signaling weakening buying pressure. On the other hand, a bullish divergence occurs when the price hits new lows but the MFI rises, suggesting selling pressure may be tapering off.

Crossovers

The MFI crossing above or below certain threshold levels (like 20, 50, or 80) can serve as signals for entry and exit points.

Combining Money Flow Index with Other Indicators

The MFI is often paired with other indicators to create a more robust trading strategy. Here are some innovative combinations:

- MFI and Bollinger Bands: When MFI shows overbought or oversold levels in conjunction with price touching the upper or lower Bollinger Band, it could enhance the reversal signal. For example, an MFI above 80 with the price near the upper Bollinger Band may signal a potential downside correction.

- MFI and Chaikin Money Flow (CMF): Both the MFI and CMF incorporate volume but in different ways. Using them together helps verify the strength of a trend. For example, if both MFI and CMF indicate positive money flow, the uptrend might be more reliable.

- MFI and Aroon Indicator: The Aroon indicator helps assess trend direction, which can provide a context for MFI signals. If the MFI shows an overbought level while Aroon indicates a weakening uptrend, it could be a compelling case to exit a position.

- MFI and Stochastic Oscillator: The Stochastic oscillator measures momentum, so pairing it with MFI can add depth to reversal signals. For example, if both indicators show oversold levels, the probability of an upward reversal might be higher.

- MFI and Average True Range (ATR): The ATR measures volatility, which can help traders decide when to apply MFI signals more aggressively. High ATR combined with an overbought MFI could indicate potential reversals with greater confidence.

Using Money Flow Index for Different Timeframes

The MFI is highly adaptable across various timeframes, allowing crypto traders to capture trends from short-term scalping to long-term investing. On shorter timeframes, such as 5-minute or 15-minute charts, MFI can identify quick entry and exit points, which is ideal for intraday traders looking to capitalize on smaller price movements. For longer timeframes, such as daily or weekly charts, the MFI can reveal larger trends and overbought or oversold conditions that may indicate a major trend reversal. Combining different timeframes can enhance decision-making, providing both short-term signals and long-term trend confirmations, which is useful in setting more reliable alerts for price shifts.

MFI as a Confirmation Tool in Trend Trading

Traders who follow trend-based strategies can use MFI as a confirmation tool for trend continuation or reversal. When the MFI remains high during an uptrend, it confirms that buying pressure is still strong. However, if the MFI starts to fall while the price is still increasing, it could be an early warning that the trend is losing momentum. Similarly, during a downtrend, a persistently low MFI supports the strength of the bearish trend. Adding MFI as a trend confirmation tool can increase the reliability of trend-following strategies, particularly when combined with other indicators like moving averages.

Setting Up Smart Crypto Alerts with MFI

In today’s fast-paced crypto market, monitoring price action 24/7 is nearly impossible. This is where Smart Alert Bots come in handy. By setting up crypto alerts based on MFI conditions, such as crossing above 80 or dipping below 20, traders can receive instant notifications when these criteria are met. For example, an alert can be triggered when MFI indicates an overbought condition while approaching a key resistance level. These alerts allow traders to react to favorable conditions promptly, enhancing the potential for profitable trades without constantly watching the markets.

Why MFI Works for Crypto Markets

Cryptocurrencies tend to exhibit high volatility and volume spikes, making the MFI especially relevant. Unlike traditional assets, where volume can sometimes lag behind price, crypto trading often experiences simultaneous spikes in price and volume due to the 24/7 market nature and high retail participation. The MFI’s ability to incorporate volume data makes it a natural fit for identifying potential reversals and trend continuations in the crypto market.

Pros and Cons of Using the Money Flow Index (MFI)

Pros:

- Volume Integration: Adds a layer of insight by accounting for volume, which is crucial for assessing buying or selling pressure.

- Easy to Interpret: Clear overbought and oversold levels.

- Flexible for Multiple Timeframes: Effective on both short and long timeframes.

Cons:

- Lagging Nature: Like most oscillators, the MFI can lag behind price, leading to delayed signals.

- Sensitive to Volume Spikes: In markets with erratic volume, the MFI can give false signals.

Practical Tips for Using Money Flow Index (MFI)

- Adjust Sensitivity: Experiment with different MFI thresholds to align with your trading strategy. For example, adjusting the overbought and oversold levels from 80/20 to 70/30 can increase the frequency of signals, but also introduces more risk.

- Combine with Trend Indicators: The MFI is best used in conjunction with trend-following indicators like the EMA or ADX, which helps confirm the direction of the trend.

- Consider Volume Conditions: Avoid using MFI as the sole indicator during periods of low volume, as it may produce unreliable signals. Higher volume periods often provide more dependable MFI readings.

The Money Flow Index can be a powerful tool in a crypto trader's arsenal, especially for those who want to consider both price movement and volume. By effectively using MFI signals with other indicators, traders can gain better insights into the market’s momentum and pressure. Whether you're seeking to identify reversal points or strengthen existing trends, the MFI provides valuable data that can help optimize trading strategies.