Order blocks are key areas on a price chart where significant institutional buying or selling has occurred, leaving behind zones of liquidity that can influence future price movements. For traders, identifying these zones is crucial for spotting potential reversal or continuation points. However, manually analyzing charts to find order blocks can be time-consuming and challenging. This is where automation and trading bots come into play. By using tools like LuxAlgo, traders can simplify the process of detecting order blocks and even automate their trades, allowing them to capitalize on these high-probability zones with precision and efficiency.

What Are Order Blocks in Trading

Order blocks are critical zones on a price chart where significant buying or selling activity has taken place, often driven by institutional traders such as banks, hedge funds, or large financial entities. These zones represent areas of concentrated liquidity and are typically seen as potential areas where price may reverse or continue its trend. Understanding order blocks is essential for both professional and retail traders, as they highlight where the “smart money” is influencing the market.

The Role of Order Blocks in Institutional Trading

In institutional trading, order blocks are the footprints of large market participants who execute substantial orders over time without causing extreme price movements. Institutions often break up their trades into smaller chunks to avoid slippage, leaving behind distinct zones of activity on the chart. These zones indicate where major decisions were made, such as accumulating or distributing assets. By identifying these areas, traders can align their strategies with the actions of institutional players, increasing their chances of success.

Why Order Blocks Matter for Retail Traders

For retail traders, order blocks provide a unique opportunity to follow the flow of institutional money. Since large institutions drive the majority of market movements, retail traders can use order blocks as high-probability zones to plan their entries and exits. These zones often act as support or resistance levels, and understanding them allows retail traders to better predict potential price reactions. Incorporating order blocks into a trading strategy helps retail traders move beyond guessing and base their decisions on actionable data tied to institutional activity.

Common Misconceptions About Order Blocks

Despite their importance, there are several misconceptions about order blocks in trading. One common myth is that order blocks guarantee price reversals or continuations, which is not always true—other factors, like market conditions and news events, can still influence price movement. Another misconception is that order blocks are easy to spot manually, but without the right tools or experience, identifying them can be challenging. Lastly, some traders confuse order blocks with traditional support and resistance levels; while they share similarities, order blocks are specifically tied to institutional activity, making them more dynamic and nuanced.

How the Order Block Trading Strategy Works

The order block trading strategy revolves around identifying and utilizing zones on the chart where institutional activity has occurred. These zones, referred to as order blocks, act as potential areas of liquidity where price is likely to react. By understanding how to identify these zones and implementing proper entry, exit, and risk management techniques, traders can create a systematic and effective strategy that aligns with the movements of institutional players.

Identifying Key Order Block Zones on a Chart

The first step in the order block trading strategy is identifying key order block zones. These zones typically appear in areas of consolidation or after sharp price movements, indicating where institutional traders have entered or exited the market. Key characteristics of order blocks include:

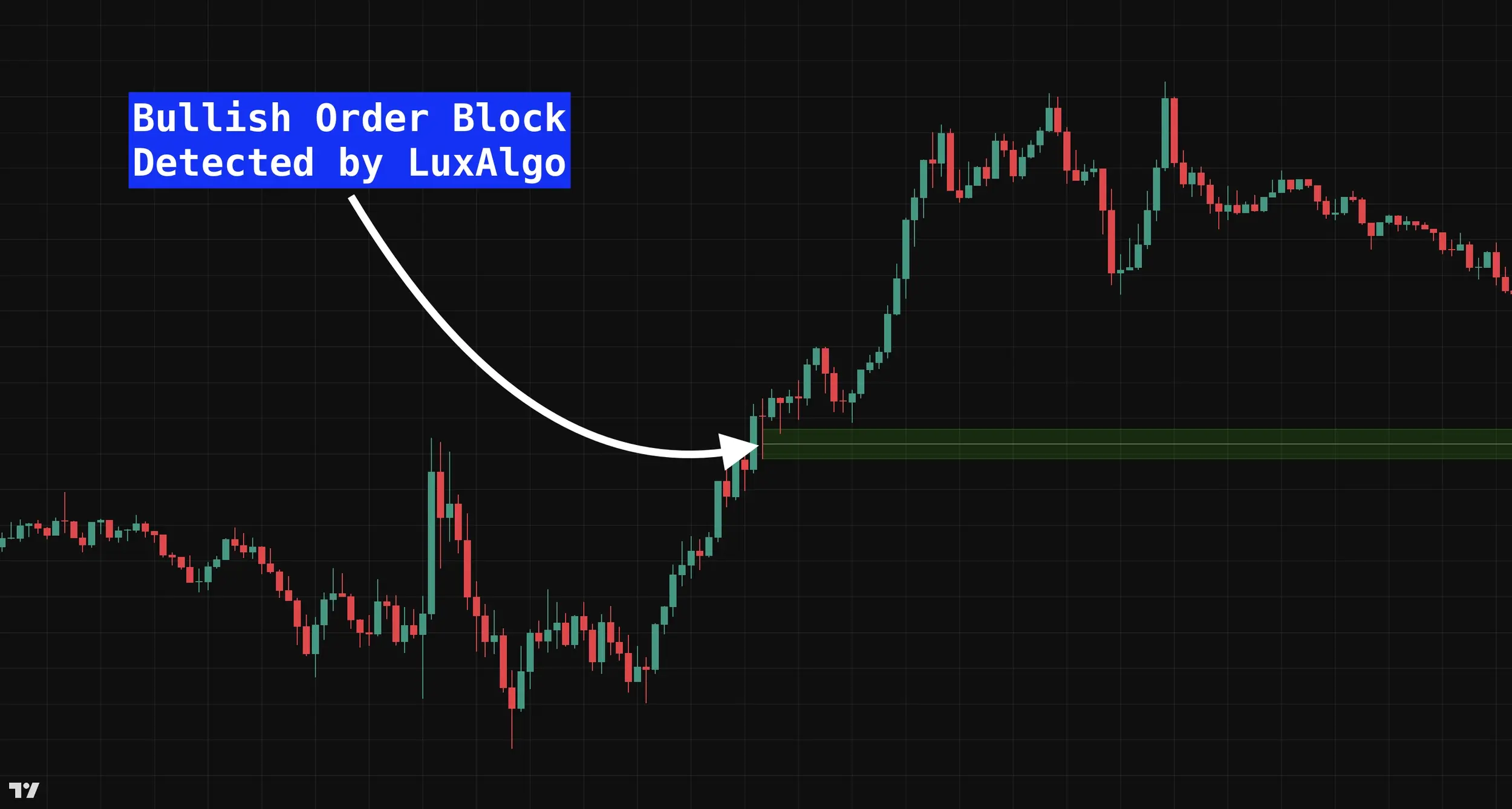

- Bullish Order Blocks: Zones where buying pressure led to a sharp upward movement after a period of consolidation.

- Bearish Order Blocks: Zones where selling pressure caused a sharp downward movement after consolidation.

To spot these zones, traders often look for areas where price breaks out with strong momentum, leaving behind clear support or resistance levels. Tools like LuxAlgo can simplify this process by automatically marking these zones on the chart, saving traders time and improving accuracy.

Entry and Exit Strategies Using Order Blocks

Once order blocks are identified, traders can use them to plan precise entries and exits:

- Entry Strategies: Entering trades at or near order blocks is common because these zones represent areas of high liquidity. For bullish order blocks, traders might wait for price to return to the zone and show signs of bullish rejection (e.g., candlestick patterns or confirmation indicators). Similarly, for bearish order blocks, traders might wait for price to retest the zone and confirm a bearish rejection.

- Exit Strategies: Exits are typically planned based on the next significant support or resistance level, or when price shows signs of exhaustion. Traders may also use trailing stop-losses to lock in profits while allowing the trade to run.

Timing is key, and combining order blocks with other technical indicators, such as moving averages or RSI, can improve the reliability of these setups.

Risk Management When Trading Order Blocks

Proper risk management is critical when trading order blocks to minimize losses and protect capital. Here are some best practices:

- Position Sizing: Always calculate position size based on the distance between your entry point and stop-loss level, ensuring you don’t risk more than a set percentage of your account (e.g., 1-2% per trade).

- Stop-Loss Placement: Place stop-loss orders slightly beyond the boundaries of the order block to protect against unexpected price movements or fakeouts.

- Avoid Overtrading: Not every order block will lead to a profitable trade. Focus on high-probability setups that align with your trading plan and market conditions.

By adhering to disciplined risk management practices, traders can maximize their potential for success while minimizing the impact of inevitable losses.

Automating the Order Block Trading Strategy with LuxAlgo

Automating the order block trading strategy can significantly simplify the trading process by reducing manual analysis and enabling trades to be executed with precision. With tools like LuxAlgo on TradingView, traders can seamlessly identify bullish and bearish order blocks and send these signals directly to a trading bot. This combination of advanced technical analysis and automation allows traders to capitalize on high-probability setups without constant chart monitoring.

What is LuxAlgo and How Does It Help

LuxAlgo is a powerful set of indicators available on TradingView that helps traders identify key zones, trends, and patterns with ease. One of its most valuable features is its ability to automatically detect order blocks and highlight them on the chart. This eliminates the need for manual identification and ensures that traders don’t miss important opportunities in the market.

With LuxAlgo’s order block detection, traders can:

- Quickly spot bullish and bearish order blocks.

- Identify areas of liquidity where price is likely to react.

- Use actionable insights to build more effective trading strategies.

LuxAlgo acts as a bridge between institutional-level analysis and retail traders, making advanced tools accessible and simplifying the process of integrating these insights into an automated trading workflow.

Setting Up LuxAlgo to Detect Order Blocks Indicator

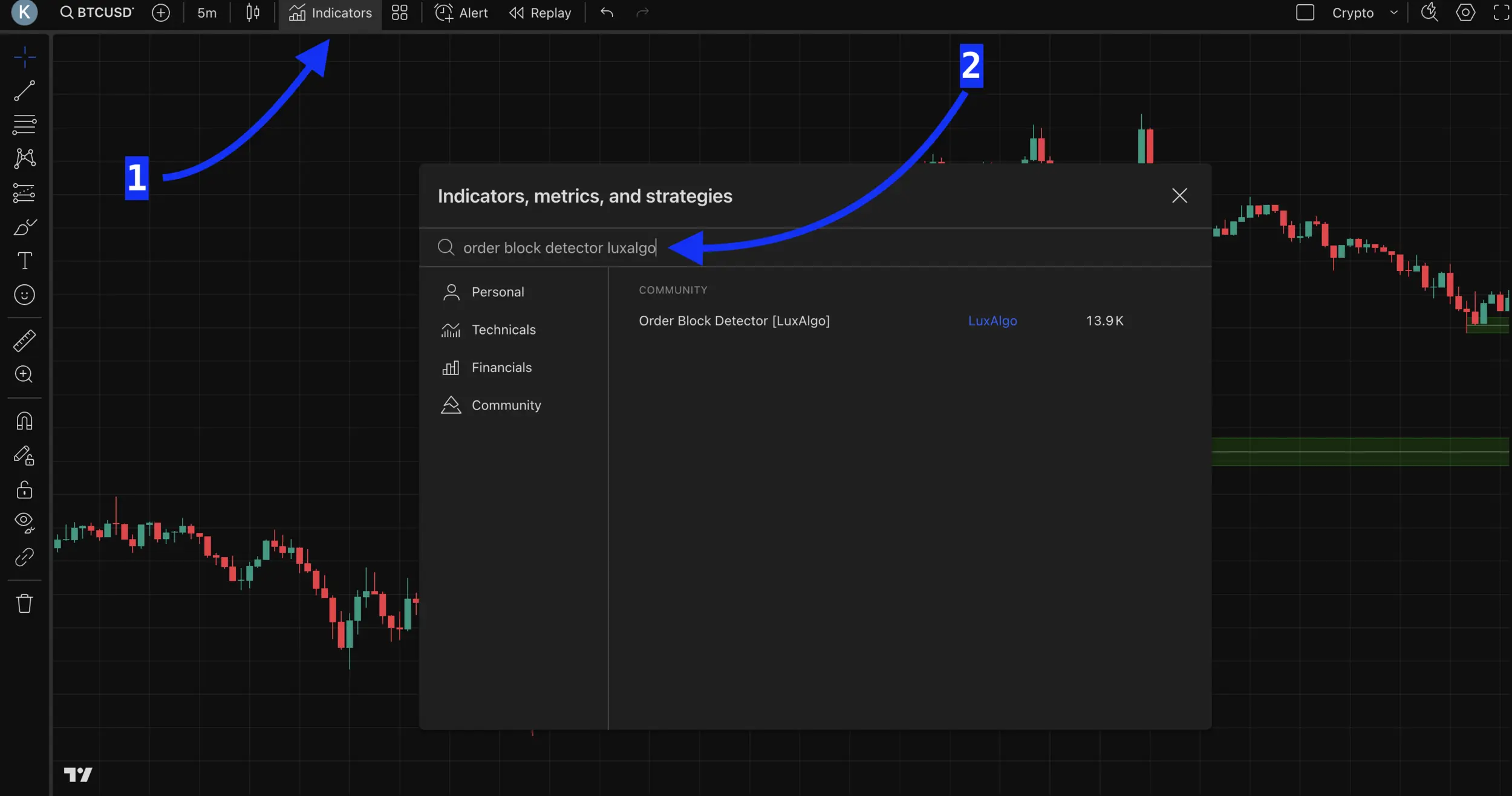

Enable LuxAlgo Order Block Detector indicator on TradingView: Add the LuxAlgo indicator to your TradingView chart by searching for "Order Block Detector LuxAlgo". Ensure you have access to the specific feature that highlights order blocks.

Set Alerts for Order Blocks

TradingView allows you to set alerts for specific conditions. Use this feature to create alerts that notify you when price interacts with an order block. For example, you can set alerts for when price enters a bullish order block, signaling a potential buy opportunity and send it as an alert to your TradingView Signal Bot.

🎥 Watch Our Step-by-Step Guide on Automating Order Block Trading Strategies

Forward Test the Strategy before using real money

Forward testing is an essential step when implementing any automated trading strategy, including the order block trading approach. By running your setup in real-time market conditions using virtual money (a demo account), you can evaluate how well the strategy performs without risking real capital. Platforms like TradingView allow you to send LuxAlgo order block signals to a trading bot connected to a demo account, enabling you to simulate trades based on live price data. This process helps you identify potential issues, refine your settings, and adjust parameters such as stop-loss, take-profit, and alert sensitivity. Forward testing with virtual money ensures that your automation setup is reliable and profitable before transitioning to live trading, offering a safe and practical way to build confidence in your strategy. Using our TradingView Signal Bots, you can first automate your strategy using virtual funds, and after a while when you are confident in the strategy, switch it to "Live Mode" to trade with real money.

Bottom Line

In conclusion, the order block trading strategy is a powerful approach that aligns retail traders with institutional market movements, offering high-probability setups for both entries and exits. By leveraging LuxAlgo on TradingView, traders can simplify the process of identifying these key zones and automate their trades using alerts and trading bots. Automation not only saves time but also reduces emotional bias, enabling consistent execution of a well-defined strategy. Whether you’re a seasoned trader or just starting out, integrating tools like LuxAlgo into your trading workflow can elevate your approach and help you navigate the markets with greater precision and confidence.