The Bullish Engulfing pattern is a powerful candlestick formation that signals potential reversals in the crypto market. Traders looking for entry points after a downtrend or those aiming to identify turning points in price action often rely on this pattern. In this post, we’ll dive into what the Bullish Engulfing pattern represents, how it can be used effectively in crypto trading bots, and explore how to combine it with indicators for greater accuracy. We'll also backtest this pattern to see its real-world performance.

What Is a Bullish Engulfing Pattern

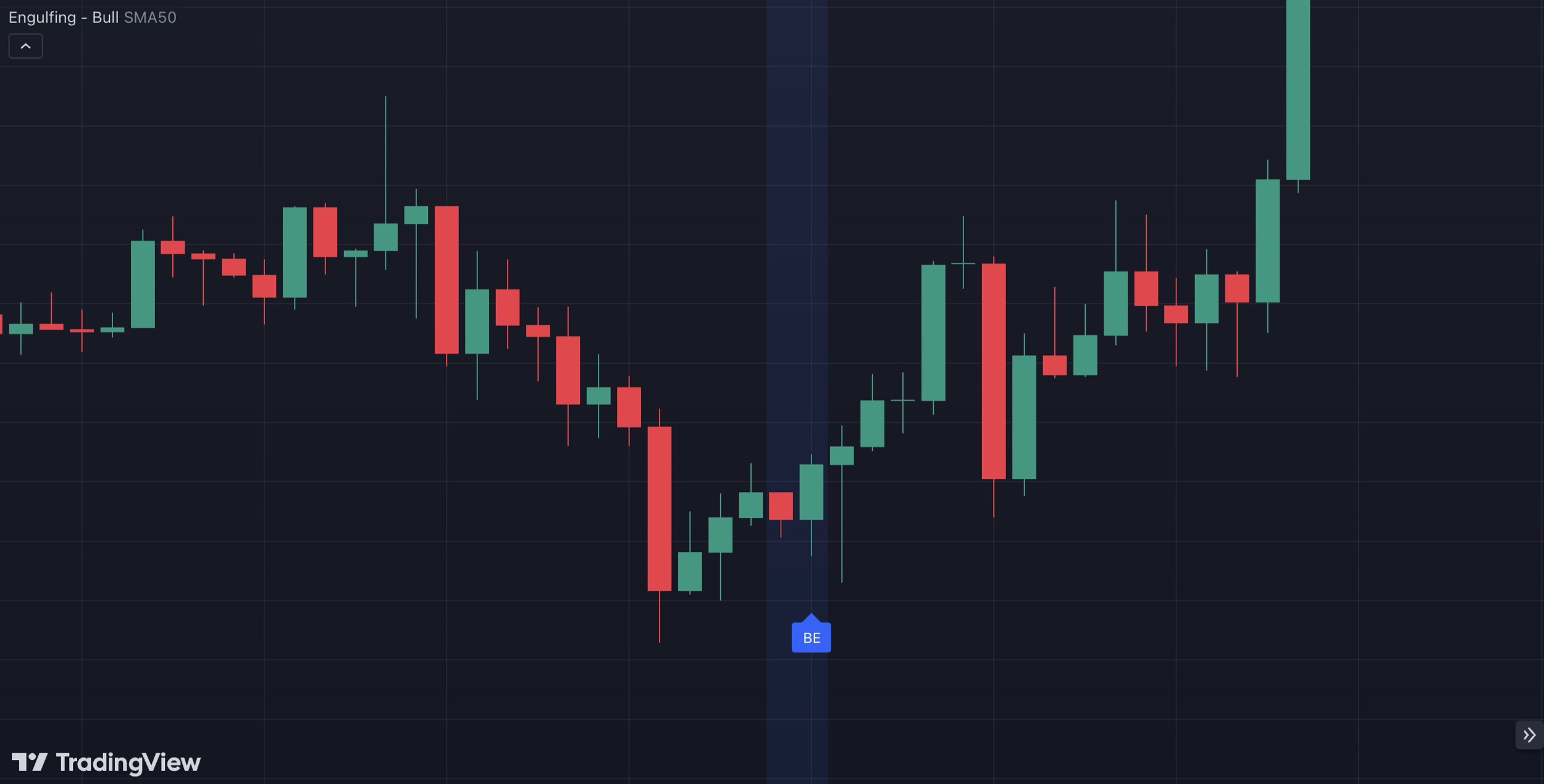

A Bullish Engulfing pattern occurs in a downtrend and consists of two candles. The first candle is bearish, showing the continuation of the downtrend. The second candle is a large bullish one that "engulfs" the body of the previous bearish candle. This pattern reflects a potential shift in market sentiment, where buyers gain control over sellers, possibly leading to a price reversal.

In crypto markets, where volatility is high, the Bullish Engulfing pattern can indicate strong upward pressure. Identifying this pattern early can allow traders to enter long positions in anticipation of further upward momentum.

How to Identify a Bullish Engulfing Pattern

- Downtrend Context: The Bullish Engulfing pattern must appear during a downtrend.

- Bearish First Candle: The first candle in the pattern should be bearish, indicating continued selling pressure.

- Bullish Engulfing Candle: The second candle is bullish and should fully engulf the body of the first candle, suggesting a reversal.

The strength of a Bullish Engulfing pattern is often confirmed when the engulfing candle’s close is near its high, which indicates buyer dominance.

Psychology Behind the Bullish Engulfing Pattern

Understanding the psychology behind the Bullish Engulfing pattern can help traders better grasp why it’s such a powerful reversal signal. This pattern is more than just a visual formation; it reflects a shift in market sentiment that may have significant implications for price direction.

In a downtrend, bears are typically in control, continuously pushing prices lower. When a Bullish Engulfing pattern appears, it signifies a moment where buyers step in with enough force to completely "engulf" the previous day’s bearish candle. This bullish candle represents a transition from selling pressure to buying enthusiasm, potentially indicating that a bottom is forming.

The large bullish candle in the pattern sends a strong message: buyers are gaining confidence and overpowering the sellers. It also shows that there may be fewer sellers left at lower price levels, as most have already exited. This switch in control is an important psychological aspect that makes the Bullish Engulfing pattern appealing to traders. By observing this change, traders can anticipate an upward momentum and position themselves accordingly.

Additionally, this pattern tends to draw attention from other traders who see it as a bullish sign, which can further increase buying pressure and contribute to a self-fulfilling reversal. When combined with higher volume, the psychological impact is even more pronounced, as the market sees this as confirmation of genuine interest from buyers. Understanding this psychological dynamic allows traders to see beyond the surface of the chart and make more informed decisions about potential market reversals.

Combining Bullish Engulfing with Other Indicators

Integrating the Bullish Engulfing pattern with indicators can improve the precision of entries. Here are some effective combinations:

- Chaikin Money Flow (CMF): This volume-based indicator helps confirm buying pressure. When a Bullish Engulfing pattern appears alongside a positive CMF, it signals that buying momentum is strong, adding confidence to a long position.

- Stochastic Oscillator: If the Stochastic Oscillator shows oversold levels (below 20) and a Bullish Engulfing pattern forms, this combination often points to a reversal opportunity.

- Bollinger Bands: When a Bullish Engulfing pattern occurs near the lower Bollinger Band, it suggests the price is likely rebounding from an oversold area, which could lead to upward movement.

- ATR (Average True Range): ATR can help measure volatility around a Bullish Engulfing pattern. If ATR is high, it suggests stronger momentum behind the bullish reversal, while lower ATR values might signal a weaker trend shift.

Combining these indicators with the Bullish Engulfing pattern provides a well-rounded approach to confirming trade setups and improving accuracy.

Advanced Strategies Using the Bullish Engulfing Pattern

For traders looking to go beyond the basic use of the Bullish Engulfing pattern, there are advanced strategies that can increase its reliability and effectiveness. By integrating additional analysis tools and techniques, traders can transform the Bullish Engulfing pattern from a simple candlestick signal into a powerful component of a sophisticated trading strategy.

Combining with Fibonacci Levels: Fibonacci retracement levels can be particularly effective when used alongside the Bullish Engulfing pattern. For example, if a Bullish Engulfing pattern forms near a 38.2% or 61.8% Fibonacci retracement level, this adds weight to the signal. The presence of both a Fibonacci level and the candlestick pattern indicates a potential support zone, where the price is likely to reverse.

Using Bullish Engulfing with Divergence: Another advanced technique is to combine the Bullish Engulfing pattern with bullish divergence on momentum indicators like the MACD or RSI. Bullish divergence occurs when the price makes lower lows, but the indicator makes higher lows, suggesting that the downward momentum is weakening. When a Bullish Engulfing pattern appears alongside this divergence, it can provide a stronger signal of a possible reversal.

Trailing Stop-Loss for Optimized Exits: The Bullish Engulfing pattern doesn’t provide an explicit exit point, so using a trailing stop-loss can be effective for managing risk. Setting a trailing stop that follows the price as it rises allows traders to capture gains while protecting against sudden reversals. For instance, traders can use a 1.5% trailing stop to gradually lock in profits as the price moves upward, ensuring that they capture part of the gains even if the market changes direction unexpectedly.

Multi-Candle Confirmation: While a single Bullish Engulfing pattern can indicate a reversal, confirming the signal with additional bullish candles can enhance its reliability. Traders might look for a sequence of three bullish candles following the engulfing pattern, which shows sustained buying interest. This approach reduces the likelihood of being caught in a false signal, as it ensures that buyers remain in control after the initial bullish reversal.

Utilizing Volume-Weighted Indicators: Volume-weighted indicators like VWAP (Volume Weighted Average Price) can help verify the validity of a Bullish Engulfing pattern. If the pattern forms near or above the VWAP line, it suggests that the buying momentum is supported by a healthy volume, giving it more credibility. In contrast, if the pattern forms with low volume, it may lack the strength needed for a true reversal.

By incorporating these advanced techniques, traders can maximize the effectiveness of the Bullish Engulfing pattern and create a more robust strategy that adapts to different market conditions. This approach also emphasizes risk management, as traders use additional tools to confirm the pattern and protect against potential losses.

Applying Bullish Engulfing in Multi-Timeframe Analysis

To maximize the effectiveness of the Bullish Engulfing pattern, it’s useful to consider multiple timeframes. Traders can spot Bullish Engulfing patterns on shorter timeframes (like 15 or 30 minutes) and confirm these on higher timeframes (such as 4-hour or daily charts) to ensure the trend alignment is in their favor. For example, if a Bullish Engulfing pattern appears on a 1-hour chart and the trend on the daily chart is also starting to shift upward, it strengthens the reversal signal.

By using multi-timeframe analysis, traders can avoid false signals and enhance their chances of entering trades that align with larger trend reversals.

Limitations of the Bullish Engulfing Pattern

While the Bullish Engulfing pattern is popular, it has its limitations:

- False Signals: In highly volatile markets, the Bullish Engulfing pattern may generate false signals, especially without volume confirmation.

- Over-Reliance on Pattern Alone: Using the Bullish Engulfing pattern in isolation can lead to inconsistent results. Combining it with technical indicators or confirmation from higher timeframes is often necessary.

- Drawdown Potential: Since the Bullish Engulfing pattern does not set a target price, traders must use stop-losses and other risk management strategies to prevent significant drawdowns.

Understanding these limitations helps traders avoid common pitfalls and reinforces the importance of a comprehensive trading approach.

Crypto Alerts for Bullish Engulfing Patterns

Setting up crypto alerts for Bullish Engulfing patterns can streamline trading decisions, allowing traders to react quickly. CryptoTailor’s Smart Alert Bots offer customizable alerts that notify traders in real-time when the Bullish Engulfing pattern appears on their chosen crypto pairs. These alerts keep traders ahead of potential reversals, enhancing their responsiveness in volatile markets. Tailored notifications for Bullish Engulfing patterns ensure you’re always ready to capitalize on key market moves.

Conclusion

The Bullish Engulfing pattern remains a valuable tool for identifying potential reversals in crypto trading. By combining this pattern with volume indicators like CMF or momentum indicators such as the Stochastic Oscillator, traders can filter out false signals and improve the effectiveness of this candlestick pattern. However, as our backtest results suggest, using the Bullish Engulfing pattern in combination with other technical tools is essential for consistent success. With the right setup and strategy, the Bullish Engulfing pattern can be a powerful addition to any trader’s toolkit.